Overseas

April 22, 2022

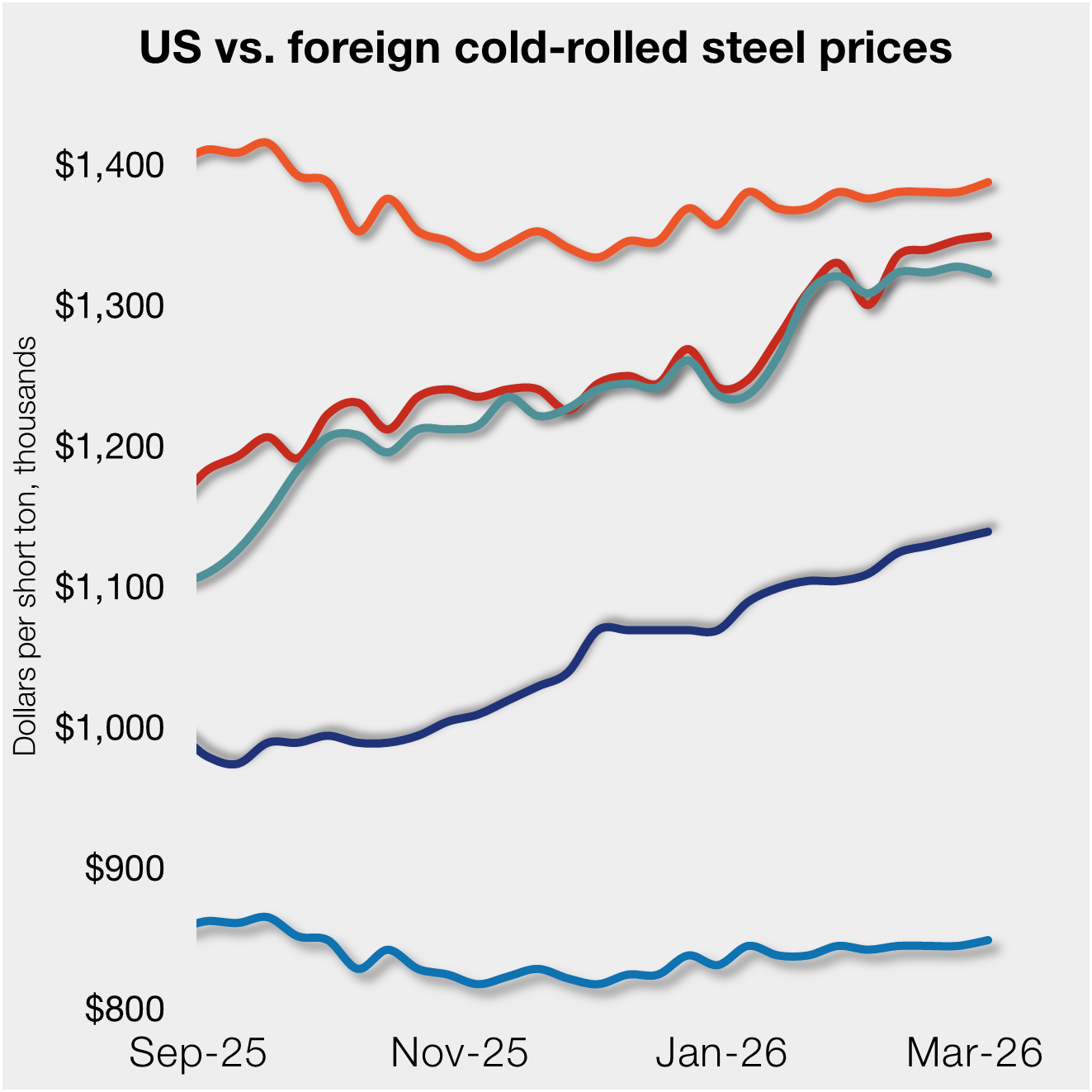

CRU: High Raw Material Costs Continue to Support US Pricing

Written by Alexandra Anderson

By CRU Prices Analyst Alexandra Anderson, from CRU’s Steel Monitor, April 21

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com