Product

January 7, 2013

Manufacturers Optimistic On Demand & Order Flows

Written by John Packard

Forty-seven percent of manufacturing companies responding to last week’s steel survey reported demand as showing improvement over the next three months based on current order flows.

During the survey, we asked the entire group being questioned, which consisted of manufacturing companies (44 percent), service centers (40 percent), steel mills (5 percent), trading companies (5 percent), toll processors (5 percent) and suppliers to the industry (1 percent), if demand was improving. As a group 25 percent responded that it was indeed improving while 12 percent felt it was in decline. The balance felt demand remained the same as previous months.

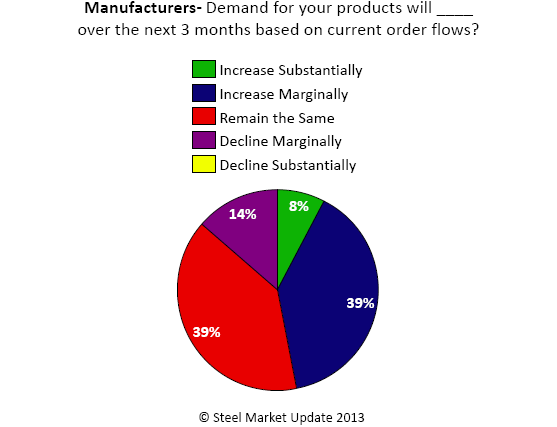

We then took the question directly to those who identified themselves as manufacturing companies and asked them based on current order flows what does demand look like over the next three months? Eight percent responded demand would increase substantially, 39 percent reported it would increase marginally, 39 percent said it would remain the same, 14 percent stated it would decline marginally while no one felt it would decline in a substantial way.

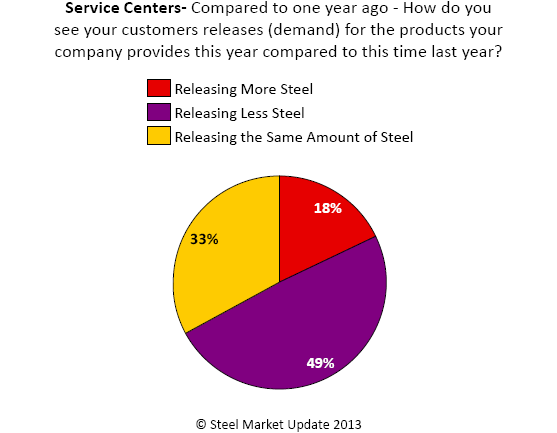

What SMU finds interesting is the contrast between the responses of the manufacturing companies and the service centers that support the manufacturing segment. The service centers are, at least at the moment, are seeing business a little differently than the manufacturing companies. According to the results of our survey, service centers are reporting their manufacturing customers are releasing less steel than one year ago at this time. A full 49 percent of the service centers reported their manufacturing customers as releasing less steel with only 18 percent releasing more material than one year ago and 33 percent the same as one year ago.

The questions are not exactly in sync with one another – and we may find the service centers adjusting their responses in future surveys if the end users are seeing improvements in order flows and demand. These improvements could create a need for steel orders if the two parties are not communicating to the degree necessary. This is something worth watching in the coming weeks.