Product

January 23, 2013

Manufacturers Report Service Center Spot Prices as Being Stable

Written by John Packard

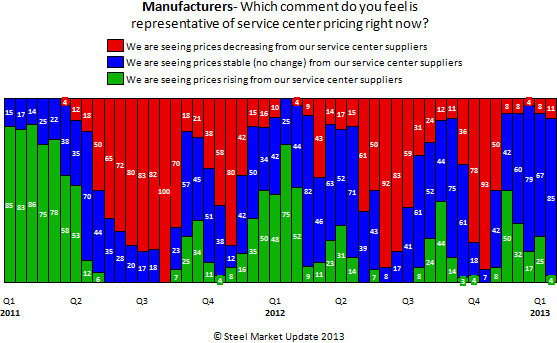

An overwhelmingly majority of manufacturers reported service center spot prices as “stable” according to the results of our survey conducted this past week. A full 85 percent of those manufacturing respondents taking our mid-January survey reported no change in spot prices from their service center suppliers. This is an increase of 18 percent compared to the beginning of January while those reporting decreasing prices rose slightly from 8 percent to 11 percent and those reporting rising prices dropped from 25 percent to 4 percent.

As you can see from our graphic below, times of pricing tranquility are few, short and far between…

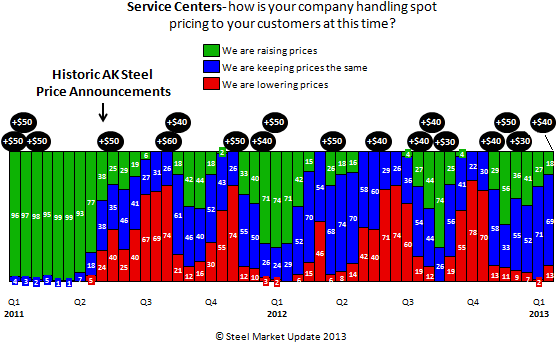

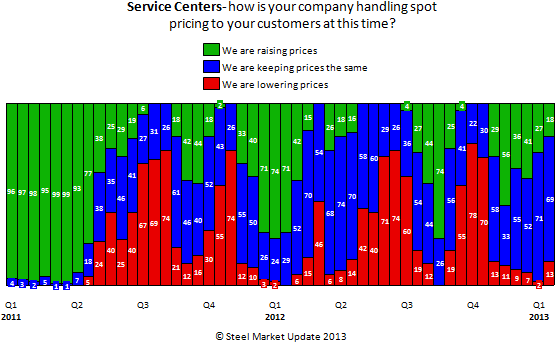

We asked service centers how they were handling spot pricing to their customers to see if they agree with the manufacturing view of the spot market and we found the majority of the service centers respondents (69 percent) reported their company was keeping spot prices the same (or stable) to their customers at this time. The remainder was split with 13 percent reporting their company was lowering prices – up 11 percent from the first week of January – while 18 percent reported they were raising prices – down from 27 percent at the beginning of this month.

As many of our readers know, SMU watches service center spot selling prices carefully as one indicator as to the strength of the market and if there are signs of “capitulation” which when seen in the past have allowed the domestic mills to announce (and collect) price increases.

We found when service centers “capitulate” – which we define as lowering prices by 70 percent or greater – the domestic mills are able to capture price increases immediately afterward. When a first announcement is made (not a continuation announcement) and service centers had not yet capitulated the increases did not stick (for example: see the +$50 announcement sitting above late 1st Quarter 2012).

At this moment, only 13 percent of the service centers are reporting they are lowering prices. We will watch with interest to see if the AK Steel announcement is able to gain traction and “stick”…