Product

February 1, 2013

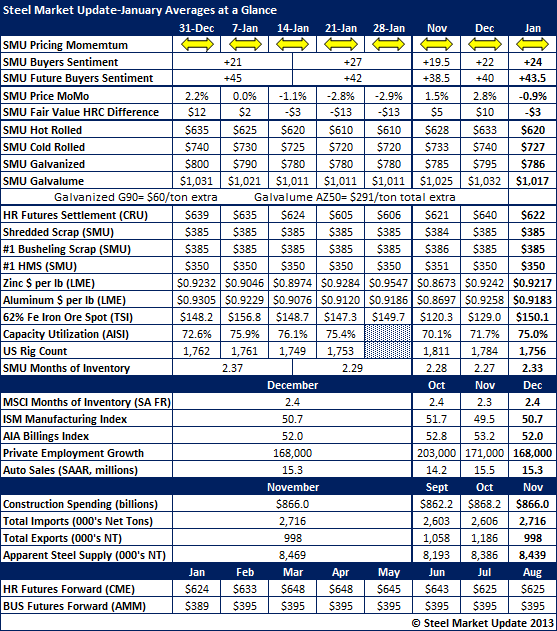

January at a Glance

Written by John Packard

This will most likely be the last time Steel Market Update will use the table below. We will begin rolling out some new products in the coming days which are meant to replace and improve upon what we have been providing our members to date. We will go into more details on the changes soon.

Until then, the table below is a quick reference to a number of the important items we saw during the month of January. The first section is items related to Steel Market Update – Momentum, Sentiment, MoMo, Fair Value and our Indices.

At the beginning of the next segment is the HR Futures settlement numbers (CRU). Since we have a comment in the US Steel article about 4th Quarter pricing the CRU October average was $592 – so, for the quarter the average of the CRU was $617.

We also show other commodities followed by capacity utilization rates (note: you cannot compare January to November and December due to capability adjustments which were made by the AISI), inventories (SMU and MSCI) and various indexes. The last section is the Forward Curve on HRC and busheling (scrap).

In the future we will begin looking at items as forward or lagging indicators – and will concentrate on those which can assist us in forecasting steel needs for the future.