Product

March 6, 2013

SMU Price Ranges & Indices: Spreads Widen

Written by John Packard

Large steel buyers with whom Steel Market Update had direct contact with over the past few working days paint a picture of the domestic mills still uncomfortable leading on pricing. Although that may be changing as word starts to spread on the newest scrap pricing.

We saw a widening of the range on hot rolled which one large HR buyer told SMU was related to the glut of plate available in the market right now. “The global oversupply of plate has put SSAB, Evraz, Nucor/Tusk, and the other Steckel mills back in the HRC market.”

We heard from service center buyers a number of mills were looking for hot rolled business and the numbers from last week had hardly budged. The same manufacturing company quoted above told us, “We are seeing quoted prices up about $20, but most mills are willing to settle for the old price of $580-$600 for an immediate order. We are also seeing mills quoting out as long as 30-60 days at about $620.”

A second manufacturing company pointed out something we have been catching in this week’s steel survey, “there seems to be a spread wider than usual between those big volume buyers and smaller ones.” We found a widening of the spread as larger buyers were many times able to cement deals last week at the low end of the range while smaller buyers saw their prices moved up by $20 per ton.

This is how we see flat rolled steel prices this week:

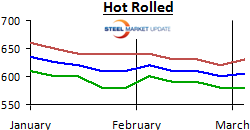

Hot Rolled Coil: SMU Range is $580-$630 per ton ($29.00/cwt-$31.50/cwt) with an average of $605 per ton ($30.25/cwt) fob mill, east of the Rockies. The lower end of our range remained the same as buyers took advantage of last minute deals while the upper end of our range increased by $10 per ton. Our average is $5 per ton higher than one week ago. The trend for hot rolled remains in Neutral as there continues to be excess supply in the market while at the same time scrap prices are rising. SMU believes there will be short-term price support as there was in January and then we will have to wait and see if supply continues to keep tapping on the brakes just as prices appear to be heading higher.

Hot Rolled Coil: SMU Range is $580-$630 per ton ($29.00/cwt-$31.50/cwt) with an average of $605 per ton ($30.25/cwt) fob mill, east of the Rockies. The lower end of our range remained the same as buyers took advantage of last minute deals while the upper end of our range increased by $10 per ton. Our average is $5 per ton higher than one week ago. The trend for hot rolled remains in Neutral as there continues to be excess supply in the market while at the same time scrap prices are rising. SMU believes there will be short-term price support as there was in January and then we will have to wait and see if supply continues to keep tapping on the brakes just as prices appear to be heading higher.

Hot Rolled Lead Times: 2-5 weeks.

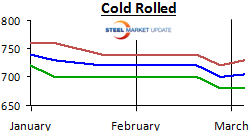

Cold Rolled Coil: $680-$730 per ton ($34.00/cwt-$36.50/cwt) with an average of $705 per ton ($35.25/cwt) fob mill, east of the Rockies. The lower end of our range did not budge from where it was one week ago while the upper end of the range increased by $10 per ton. Our average is now $5 higher than one week ago. The trend for cold rolled remains at Neutral as the market digests the new scrap numbers and determines if there is enough demand to support them.

Cold Rolled Coil: $680-$730 per ton ($34.00/cwt-$36.50/cwt) with an average of $705 per ton ($35.25/cwt) fob mill, east of the Rockies. The lower end of our range did not budge from where it was one week ago while the upper end of the range increased by $10 per ton. Our average is now $5 higher than one week ago. The trend for cold rolled remains at Neutral as the market digests the new scrap numbers and determines if there is enough demand to support them.

Cold Rolled Lead Times: 4-6 weeks.

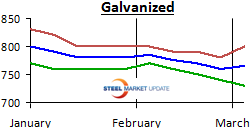

Galvanized Coil: SMU Base Price Range is $33.50/cwt-$37.00/cwt with an average of $35.25/cwt plus applicable extras, fob mill, east of the Rockies. SMU picked up a number of “deals” cut during the middle of this past week at the low end of our range (mostly on light gauge) and we saw our base drop by $10 per ton compared to one week ago. The upper end of our range rose by $20 per ton which brought our average up by $5 per ton. The trend for galvanized remains at Neutral as we wait to see if higher scrap prices will prompt buyers to buy 2nd Quarter needs resulting in some longer lead times. Time will tell.

Galvanized Coil: SMU Base Price Range is $33.50/cwt-$37.00/cwt with an average of $35.25/cwt plus applicable extras, fob mill, east of the Rockies. SMU picked up a number of “deals” cut during the middle of this past week at the low end of our range (mostly on light gauge) and we saw our base drop by $10 per ton compared to one week ago. The upper end of our range rose by $20 per ton which brought our average up by $5 per ton. The trend for galvanized remains at Neutral as we wait to see if higher scrap prices will prompt buyers to buy 2nd Quarter needs resulting in some longer lead times. Time will tell.

Galvanized .060” G90 Benchmark: SMU Range is $730-$800 per ton with an average of $765 per ton.

Galvanized Lead Times: 4-7 weeks.

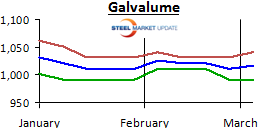

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.50/cwt with an average of $36.25/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range remained the same while the upper end of the range rose by $10 per ton. Our average is up $5 per ton compared to this time last week. The trend for Galvalume is for prices to be Neutral as we wait to see if lead times stretch, scrap prices have any impact or we continue to be in an over-supplied situation.

Galvalume Coil: SMU Base Price Range is $35.00/cwt-$37.50/cwt with an average of $36.25/cwt plus applicable extras, fob mill, east of the Rockies. The lower end of our range remained the same while the upper end of the range rose by $10 per ton. Our average is up $5 per ton compared to this time last week. The trend for Galvalume is for prices to be Neutral as we wait to see if lead times stretch, scrap prices have any impact or we continue to be in an over-supplied situation.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $991-$1041 per ton with an average of $1016 per ton.

Galvalume Lead Times: 5-8 weeks.