Product

August 16, 2013

Hot Rolled Futures Rise Slightly During the Summer Lull…

Written by Bradley Clark

It seems that the August month has brought with it a true summer lull. Trading volumes have been very low in the HRC futures market the past couple of weeks as many traders seem happy to sit on the sideline and await what the Autumn has to bring.

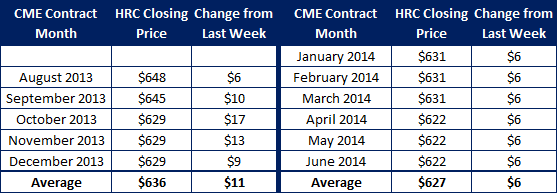

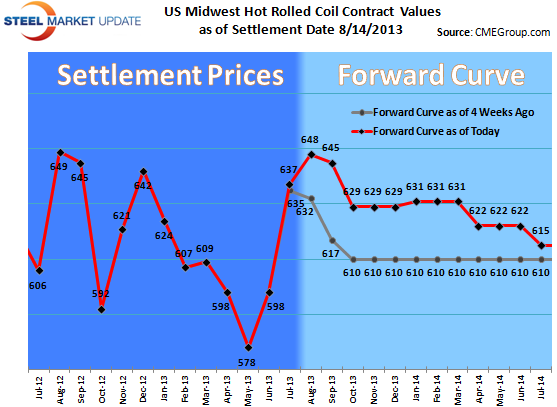

The forward curve has risen ever so slightly over the past week as the physical market seems to be holding for the time being. However, there is definitely a feeling of the market coming off being a question of ‘when’ rather than ‘if’. For now the curve remains backwardated with Q4 trading between $620-628 per ton and the cal 14 value around $617.

It is hard to say much more as prices are relatively unchanged, bids and offers in the market are more indicative than firm this week and little news in the underlying market have conspired to create a wait and see atmosphere in the Futures space.