Prices

November 19, 2013

Apparent Steel Supply for September

Written by Brett Linton

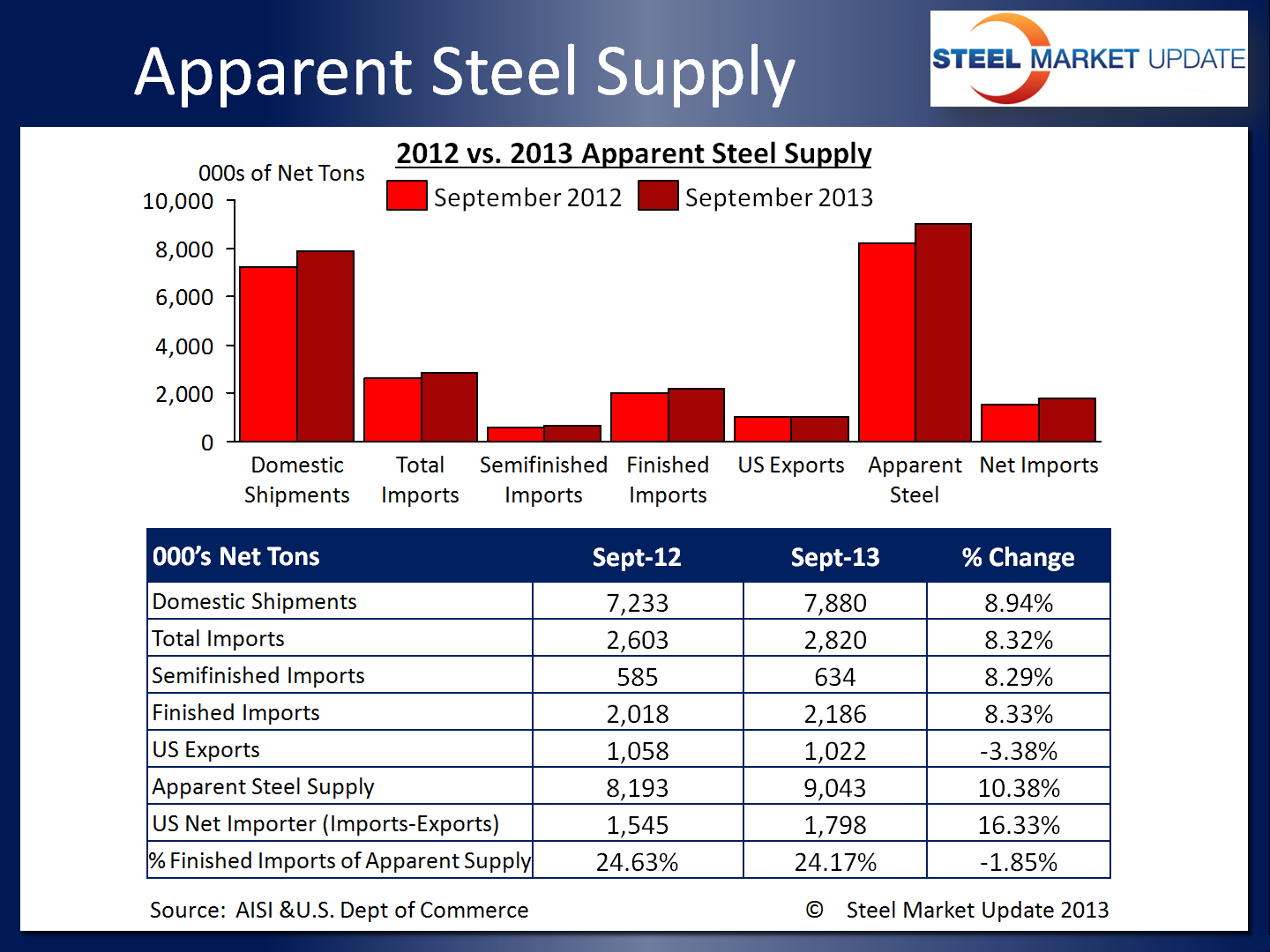

Apparent steel supply for September was 9,043,000 net tons, a 10.38 percent increase compared to the same month one year ago. This is due to an 8 to 9 percent increase in domestic shipments and all imports, and was slightly offset by a decrease in exports, down 3.38 percent. The net trade balance from the difference between imports and exports was a surplus of 1,798,000 net tons in September, an increase of 16.33 percent from one year prior.

When compared to last month when apparent steel supply was at 9,416,000 NT, September supply is slightly lower by 3.96 percent. Domestic shipments also decreased over the previous month by 5.55 percent. However, the net trade balance between imports and exports increased slightly in September over August by 3.85 percent.

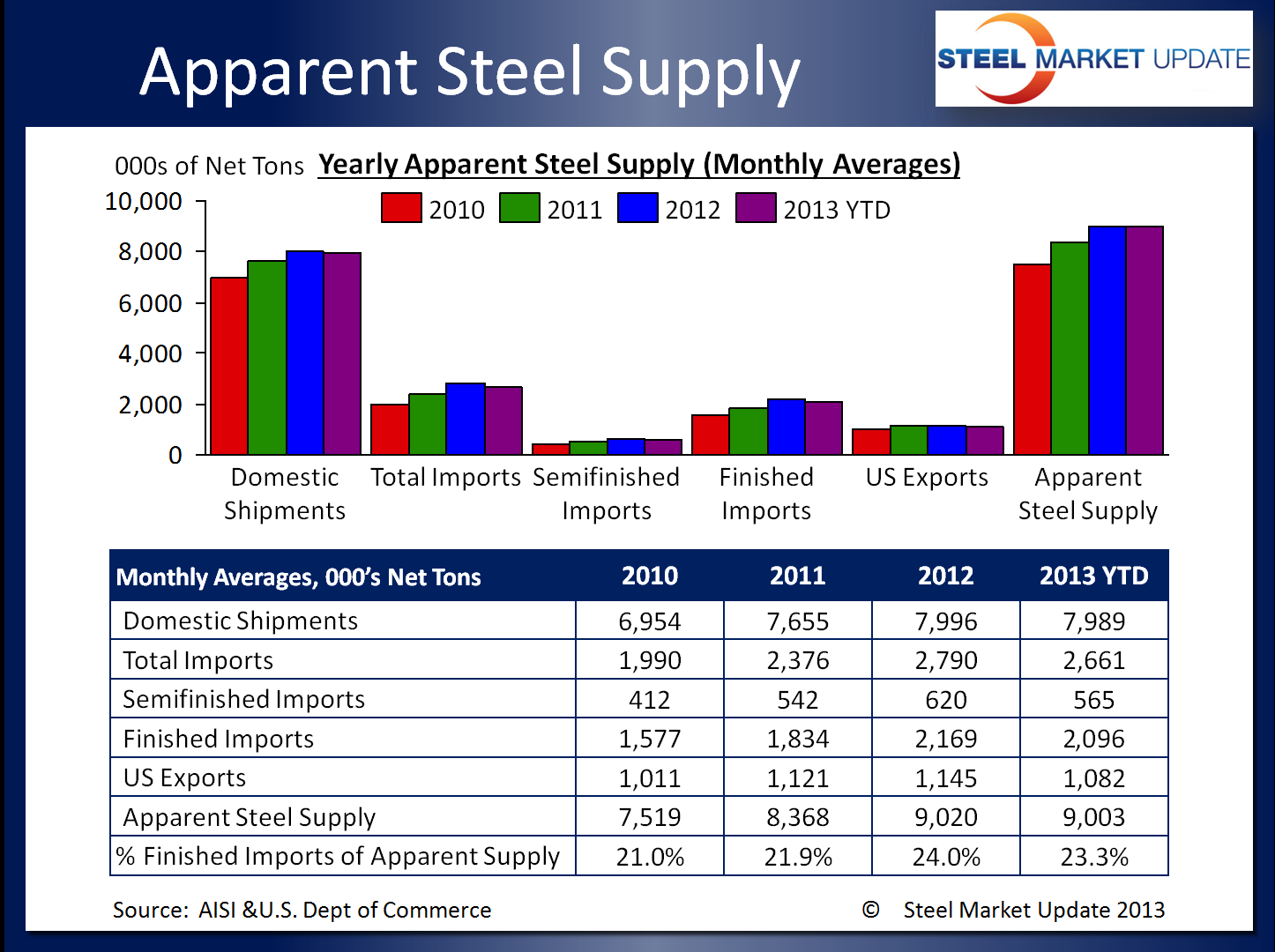

On a year to date basis, all of the 2013 YTD figures are very close to what we saw during in 2012 and significantly higher than 2010 and 2011 figures.