Prices

January 14, 2014

Prepainted Flat Rolled Imports Fall Significantly in November

Written by Brett Linton

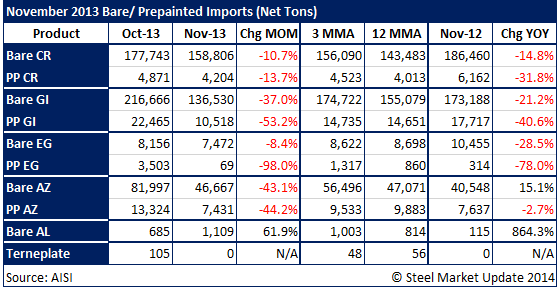

November prepainted flat rolled imports decreased over October, especially on galvanized and Galvalume products. The four prepainted products tracked by SMU fell a combined 21,941 net tons (NT) or 49.7 percent over the previous month. Compared to the same month one year ago, prepainted imports were down 30.2 percent on average for select products.

As you can see by our table below – prepainted cold rolled (CR) imports declined by 667 NT or 13.7 percent from October to November. November tonnage was below the 3-month moving average (3MMA) but above the 12-month moving average (12MMA) calculated through November. Compared to levels one year ago, prepainted CR imports were down 1,958 NT or 31.8 percent.

Prepainted galvanized (GI) imports decreased by 11,947 NT or 53.2 percent from November to October- these are levels significantly below both the 3MMA and 12MMA. Compared to one year ago, prepainted GI imports are down 7,199 NT or 40.6 percent.

November prepainted electro-galvanized (EG) imports dwindled by 3,434 NT or 98.0 percent month-over-month, well below both the 3MMA and 12MMA. Compared to one year ago, prepainted EG imports are down 245 NT or 78.0 percent. Note that prepainted EG imports are much smaller than the other products in this comparison, and fluctuations in imports from China tend to skew the figures from month to month.

Prepainted Galvalume (AZ) imports declined by 5,893 NT or 44.2 percent over last month. November tonnage was well below both the 3MMA and 12MMA. Tonnage imported in November was down slightly- 206 NT or 2.7 percent over the same month one year ago. (Source: US Department of Commerce)

Below is an interactive graph showing our prepainted import history back to 2010. Note that you must be reading this article on the website in order for the interactive graph to display and function.

{amchart id=”104″ Prepainted Flat Rolled Imports}