Analysis

January 18, 2014

Housing Permits & Starts Growth Slowed Throughout 2013

Written by Peter Wright

The most significant observation about housing permits and starts in 2013 was how the growth rate of both single and multi-family slowed progressively during the year. The three month moving average (3MMA) of the year-over-year growth rate of single family declined from 29.6 percent in March to 10.8 percent in December as multi-family declined from 51.1 percent in February to 13.7 percent in December.

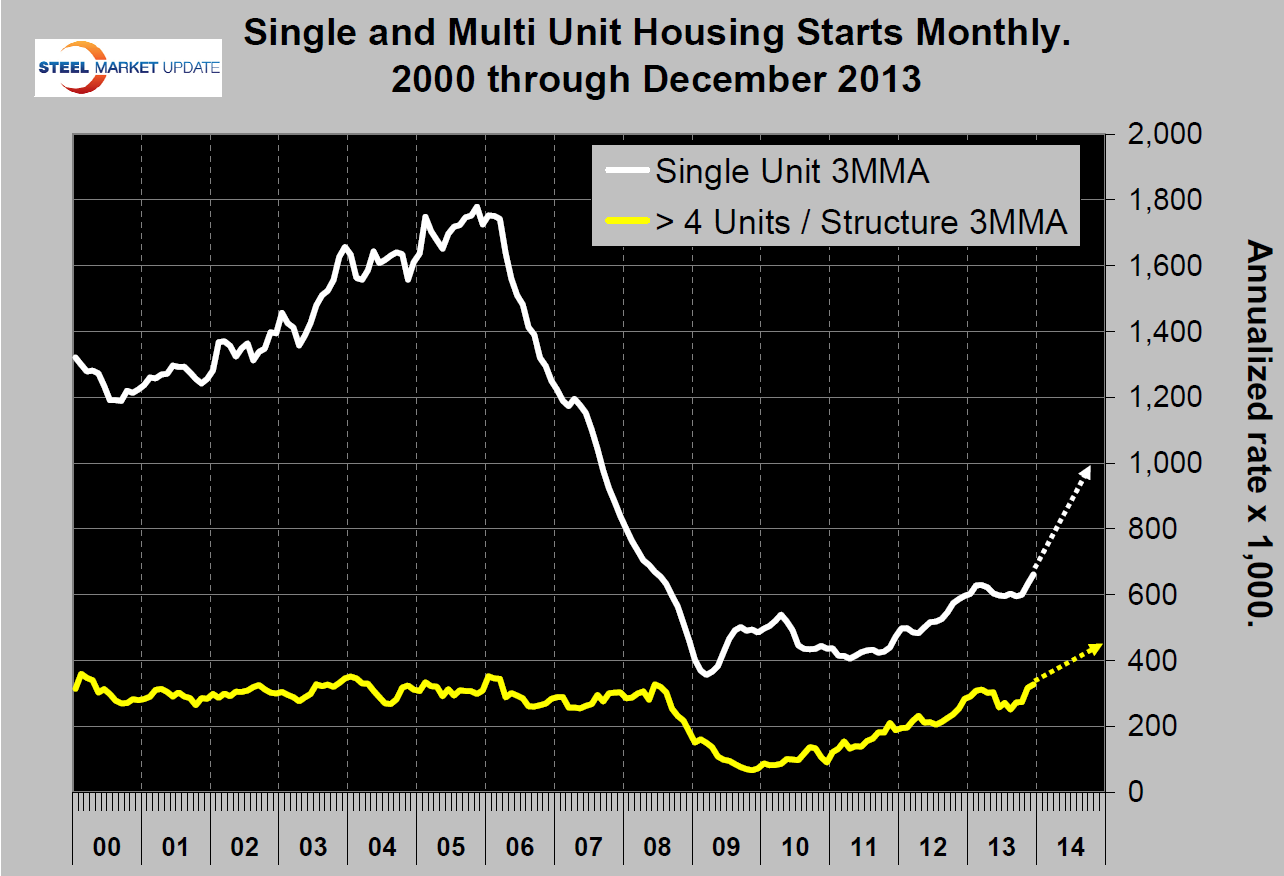

The good news is that the 3MMA of total starts exceeded a million in the Q4 for the first time since the recession. The decline in the y/y growth rates is probably a result of the mortgage shock in the spring when rates rose by about 1 percent. In Q4 the growth trajectory of both single and multi-family returned to their previous levels (Figure 1). At the present rate of increase, single family could reach the one million rate around October next year.

The good news is that the 3MMA of total starts exceeded a million in the Q4 for the first time since the recession. The decline in the y/y growth rates is probably a result of the mortgage shock in the spring when rates rose by about 1 percent. In Q4 the growth trajectory of both single and multi-family returned to their previous levels (Figure 1). At the present rate of increase, single family could reach the one million rate around October next year.

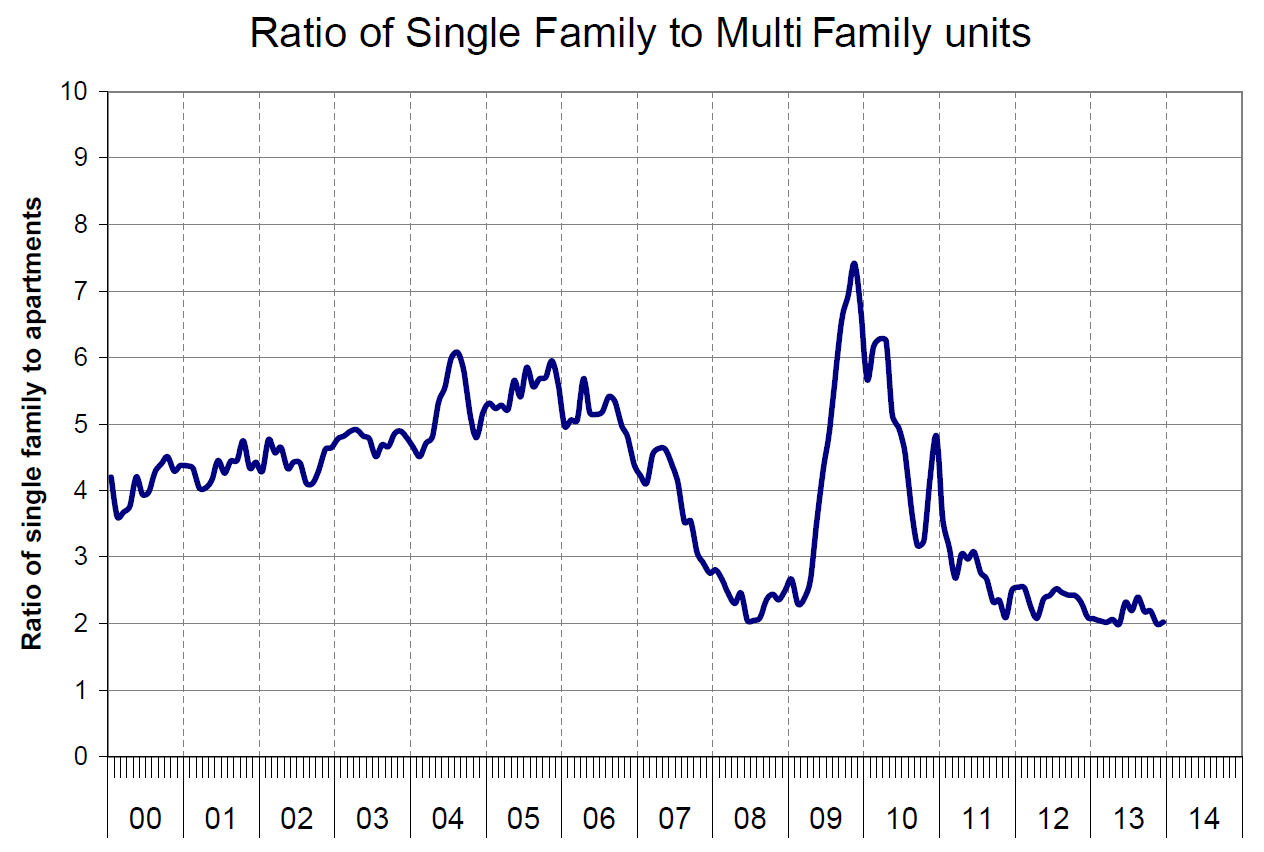

Multi-family has already fully recovered from the recession so future growth will depend on the ratio of single to multi-family construction. Before the recession this ratio ranged between five and six single units to one multi-family unit. Today that ratio is two and showing no sign of reverting to the pre-recession level (Figure 2). The recent surge in starts was driven primarily by the South region and to a lesser extent by the West. The North East is not doing well, the Mid West declined slightly in Q4.

Multi-family has already fully recovered from the recession so future growth will depend on the ratio of single to multi-family construction. Before the recession this ratio ranged between five and six single units to one multi-family unit. Today that ratio is two and showing no sign of reverting to the pre-recession level (Figure 2). The recent surge in starts was driven primarily by the South region and to a lesser extent by the West. The North East is not doing well, the Mid West declined slightly in Q4.

From April through October total permits exceeded total starts every month. In November starts surged past permits then in December they equalized. Basically the history of this ratio bodes well for housing construction as we move into 2014.

The NAHB composite sentiment index has been in the range 56 to 58 since July indicating optimism in the minds of home builders. In December sentiment ranged from 42 in the North East to 71 in the West. Any number below 50 indicates pessimism and vice versa.