Prices

January 30, 2014

2013 Imports Analysis

Written by Brett Linton

Using December license data, total 2013 imports are projected to have been 32,146,101 net tons (NT). This is a decrease of 4.0 percent from the 33,474,544 NT imported in 2012, however when compared to 2011 figures, 2013 total imports were up 12.7 percent.

Looking back to 2007, prior to the recessionary period and where trade figures were more or less ‘normal’, total imports were 33,243,522 NT, 3.3 percent lower than 2013 figures.

China exported a total of 1,906,346 net tons to the United States up 14.9 percent over 2012’s 1,659,801 net tons.

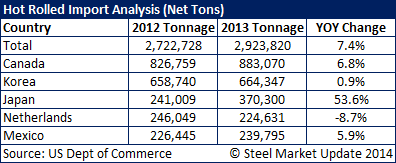

When looking at imports by product we found hot rolled imports increased by 7.4 percent over the previous year. The country with the biggest change from year to year was Japan which increased its participation by 53.6 percent.

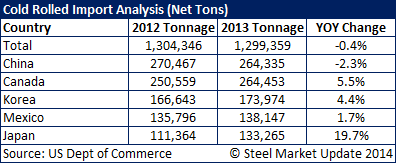

Cold rolled imports dropped by a mere 0.4 percent. Even with all of the talk about China “surging” on cold rolled the numbers actually indicate China was down 2.3 percent. As with hot rolled, Japan was the country making the move into the USA market – up 19.7 percent on cold rolled.

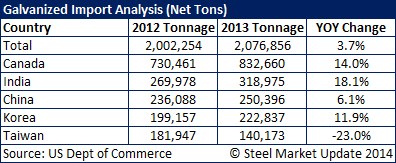

Galvanized imports increased by 3.7 percent in 2013 vs. 2012. India galvanized exports to the U.S. grew by 18.1 percent. On the flip side Taiwan exports dropped by 23.0 percent.

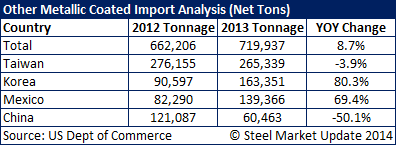

Other metallic coated (mostly Galvalume) imports rose by 8.7 percent. We saw large changes from Korea (+80.3 percent) and Mexico (+69.4 percent) while China exports of “other metallic” dropped by 50.1 percent.

In an AIIS press release Executive Director Richard Chriss says, “The steel market in 2013 started weak due in part to uncertainty related to the federal government’s so-called fiscal crisis, which virtually eliminated the early seasonal improvement for the year. The market in 2013 never caught up after the disappointing start. The good news at this point in 2014 is that the normal seasonality appears to have kicked in as demand and pricing have improved early in 2014. Whether this improved market has staying power at this point is hard to judge, though.”