Prices

February 4, 2014

Semi-Finished and Hot Worked Steel Imports through January 2014

Written by Peter Wright

Imports of total flat rolled products increased in January to 990,803 tons from 852,840 in December. Total long products increased from 412,848 to 552,093 tons. Total sheet products as a sub set of flat rolled increased from 677,510 to 775,337 tons. Semi finished declined from 604,558 to 532.813 tons.

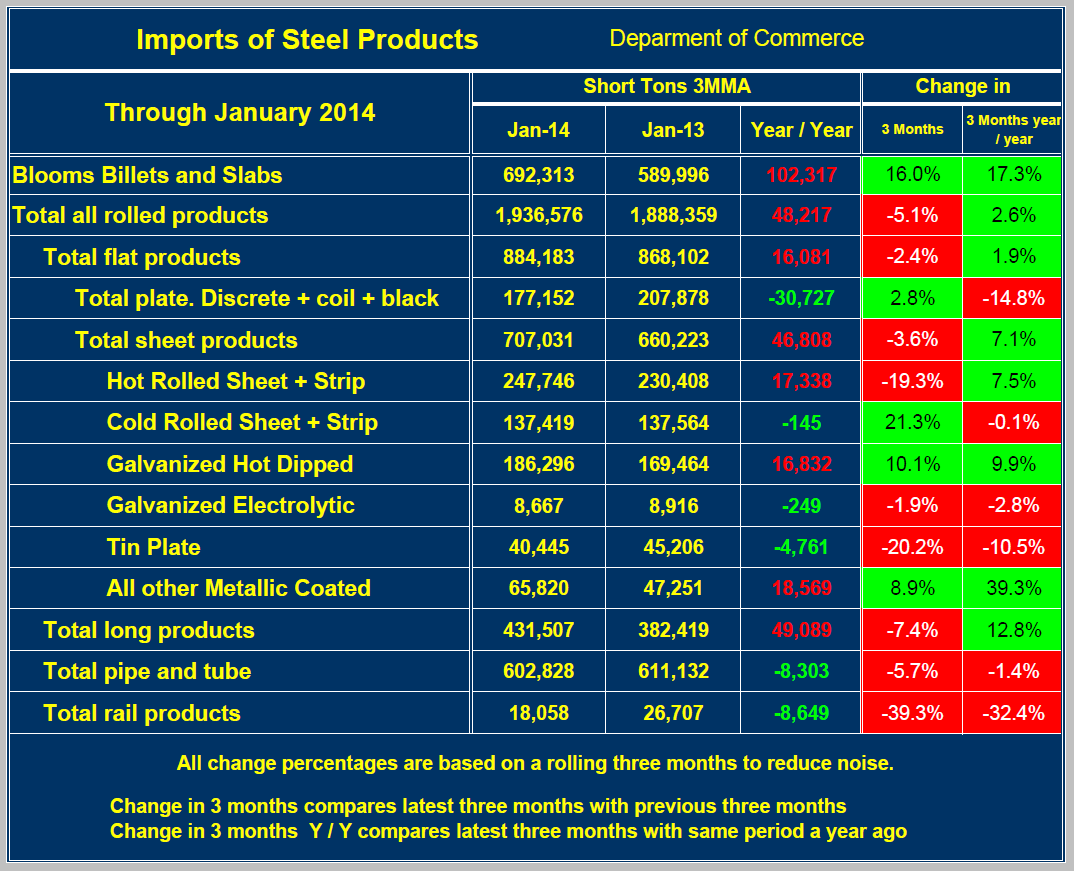

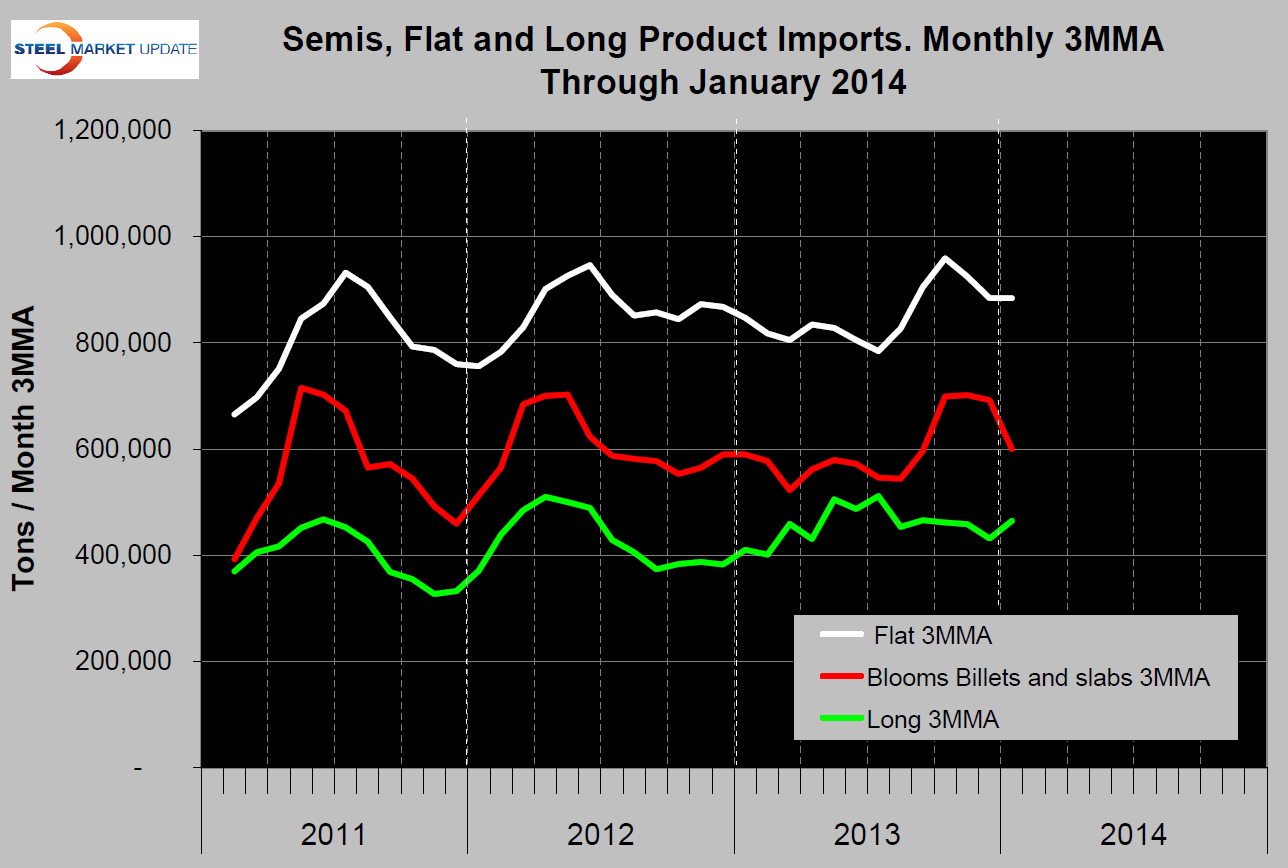

An analysis of the 3 month moving averages (3MMA) of imports in January results in a different picture compared to the same period last year and to the previous three month period, August through October. For the purpose of this analysis we have used January’s licensed data, December preliminary data and November’s final result. We believe it is valid to include license data in this way because they have a good track record of approximating the final numbers and at this macro level of analysis we are concerned more with direction that we are with absolutely accurate numbers. Figure 1 is a graphical view of the 3MMA since January 2011. In January 2104 this average was exactly flat for flat rolled, semi finished declined quite substantially back to the September level and long products increased slightly. Table 1 provides a detailed import analysis and compares the average monthly tonnage of the three months through January, with both the same period last year and with three months through October. The total tonnage of all hot worked products averaged 1,936,576 tons per month in three months through January, down by 5.17% from August through October. Table 1 shows the tonnage and percent change for all the major product groups and for sheet products in detail. On this basis the expected import surge has not yet happened but the results for the individual month of January may be a harbinger of things to come.

An analysis of the 3 month moving averages (3MMA) of imports in January results in a different picture compared to the same period last year and to the previous three month period, August through October. For the purpose of this analysis we have used January’s licensed data, December preliminary data and November’s final result. We believe it is valid to include license data in this way because they have a good track record of approximating the final numbers and at this macro level of analysis we are concerned more with direction that we are with absolutely accurate numbers. Figure 1 is a graphical view of the 3MMA since January 2011. In January 2104 this average was exactly flat for flat rolled, semi finished declined quite substantially back to the September level and long products increased slightly. Table 1 provides a detailed import analysis and compares the average monthly tonnage of the three months through January, with both the same period last year and with three months through October. The total tonnage of all hot worked products averaged 1,936,576 tons per month in three months through January, down by 5.17% from August through October. Table 1 shows the tonnage and percent change for all the major product groups and for sheet products in detail. On this basis the expected import surge has not yet happened but the results for the individual month of January may be a harbinger of things to come.

The United States International Trade Commission (USITC) has released the final decision concerning the second extension of Trade Restrictions on HRC from China, India, Indonesia, Taiwan, Thailand and Ukraine, since the five-year validity period of the duties imposed on December 27th, 2007, expired. The USITC believes that lifting of the restrictions will again result in dumping, which will damage the US national industry. As a result, HRC from China, India, Indonesia, Taiwan, Thailand and Ukraine will remain subject to anti-dumping duties. Moreover, countervailing duties will be imposed on products from India, Indonesia and Thailand. The investigation followed an application lodged by ArcelorMittal USA, U.S. Steel, Nucor, Gallatin Steel, Steel Dynamics and SSAB Americas.

Explanation: In order to reduce noise in the data it’s better to compare rolling three month periods which gives a real feel of trade flows. License data does not include district of entry so those details are delayed by an additional month. We believe that both a table and a graph are necessary because they provide a quite different but complimentary picture. The table is a snapshot of product detail with a short time element. The graph provides much less detail but gives a longer term perspective which is essential in understanding the current situation. SMU will continue the very detailed analysis of tonnage by source country and port of entry for individual sheet products in its premium service.