Prices

February 14, 2014

World Export Price vs. Domestic HRC Pricing

Written by John Packard

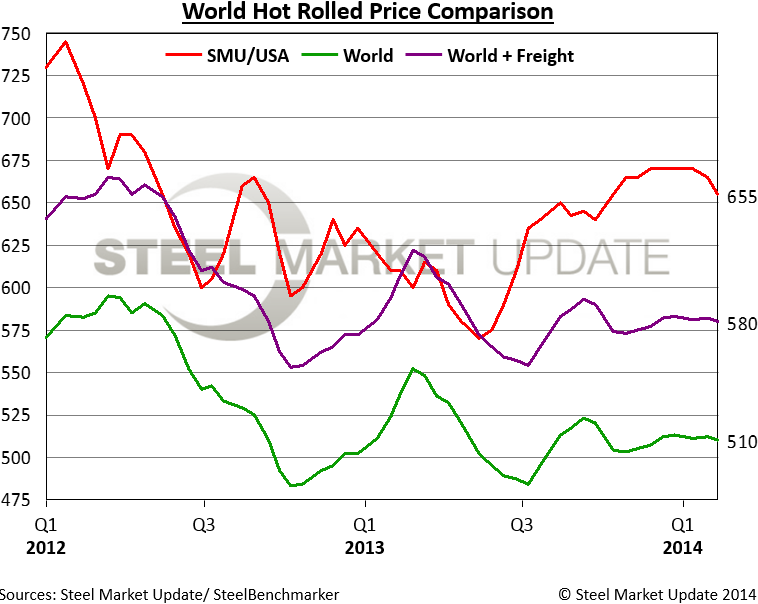

One of the questions Steel Market Update is asked, is can we compare domestic hot rolled pricing vs. world export price? The spread, which we have seen referenced as high as $150 per ton in other publications, can be somewhat deceiving if not evaluated properly.

The world export prices on hot rolled coil (HRC) as provided earlier this week to SMU and the steel community is referenced as being $510 per net ton, fob the port of export. On the surface it appears the spread between domestic, which SMU pegged at $655 per net ton earlier this week, and world export prices is $145 per ton. Just about any domestic buyer would buy foreign hot rolled if they could actually purchase the product delivered to USA port $145 per ton less expensively than that from their domestic suppliers.

However, what has not been considered is the cost to move the steel from Europe, Asia, Africa or South America by ship, then the cost to load and unload the ship, insurance and a margin for the trading company who has sold the material to the USA customer. Coming from Asia SMU calculates the total costs to be approximately $70 per net ton. Out of Europe and South America those costs would most likely be slightly lower (approximately $10-$15 per ton).

When taking the costs into consideration we find the spread between world export prices and domestic averages to be $60-$75 per ton.

We did a quick check of the price offers being made on foreign HRC into the U.S. We found numbers into Chicago at slightly more than $600 per net ton and into the port of Houston at approximately $570-$580 per ton which supports our calculations provided in our table below.

It is believed a number of the domestic mills stopped pushing hot rolled prices higher over the past couple of months due to worries regarding the spread between domestic and foreign steel prices. Anytime you start to see spreads at, or exceeding, $100 per net ton buyers will gravitate to imported steel. Even at $60 per ton there are some who will move toward foreign steel depending on the lead times to get the steel and the perceived direction of domestic prices. With domestic prices now slipping, the spread will need to be at the higher levels ($100 or higher) in order to lessen risks for buyers. Inland freight is also a factor as those located close to ports (Houston, New Orleans, Savannah, Camden, Los Angeles, etc.) are more inclined to buy foreign than those located inland where freight becomes an overriding factor.