Prices

April 8, 2014

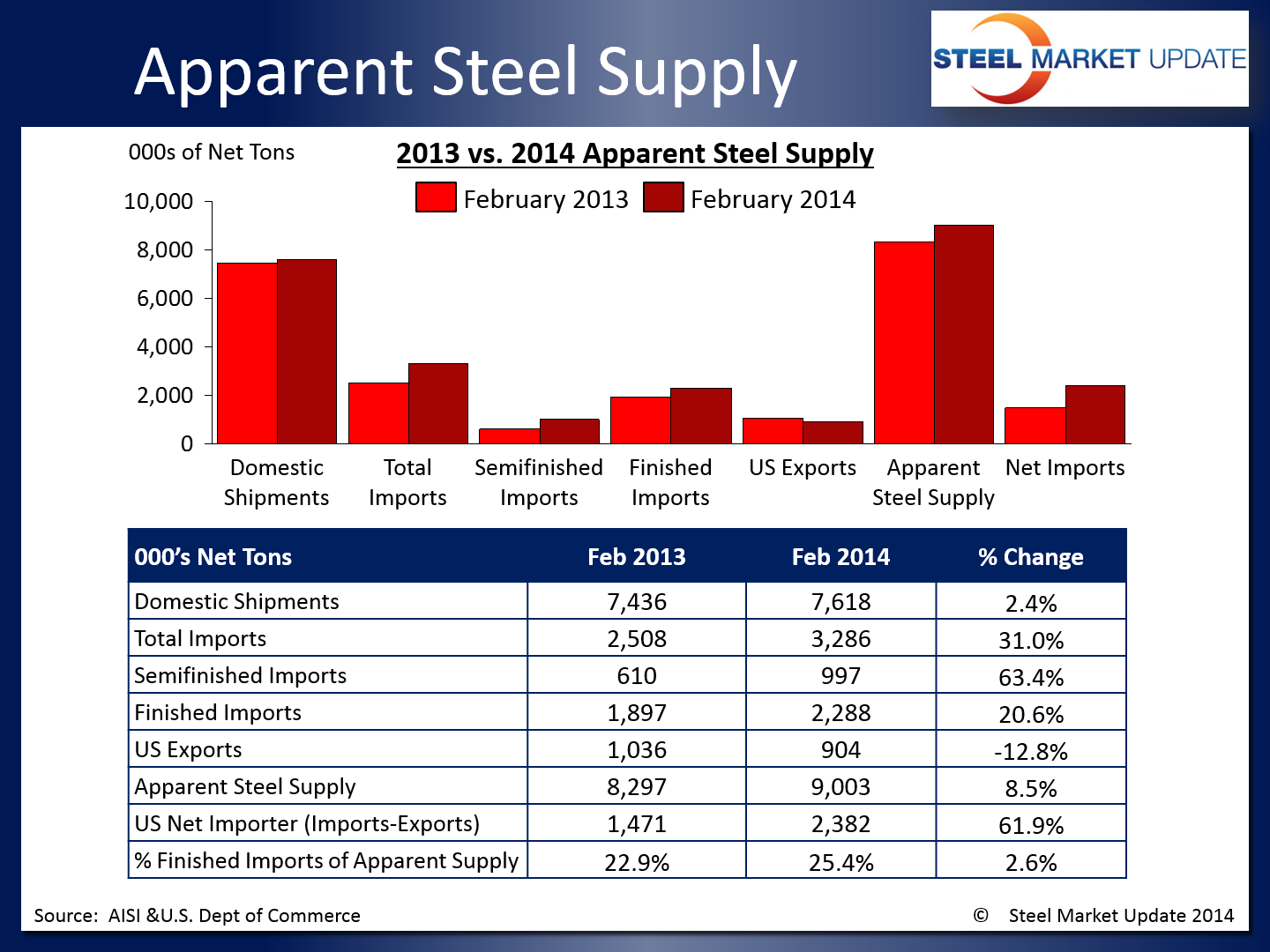

Apparent Steel Supply at 9 Million Tons in February

Written by Brett Linton

Apparent steel supply for February was 9,002,702 net tons, an 8.5 percent increase compared to the same month one year ago. This is due to an increase in finished imports and domestic shipments but a decrease in total US exports. The net trade balance between imports and exports was a surplus of 2,381,742 net tons in February, an increase of 61.9 percent from the same month last year. Import penetration continues to be of concern to the domestic steel industry as their percentage of apparent steel supply has been rising and now exceeds 25 percent (2013 average was 23.2 percent).

When compared to last month, when apparent steel supply was at 9,386,260 NT, February supply decreased by 383,558 NT or 4.1 percent. This is due to a decrease in domestic shipments, finished imports, and total exports.

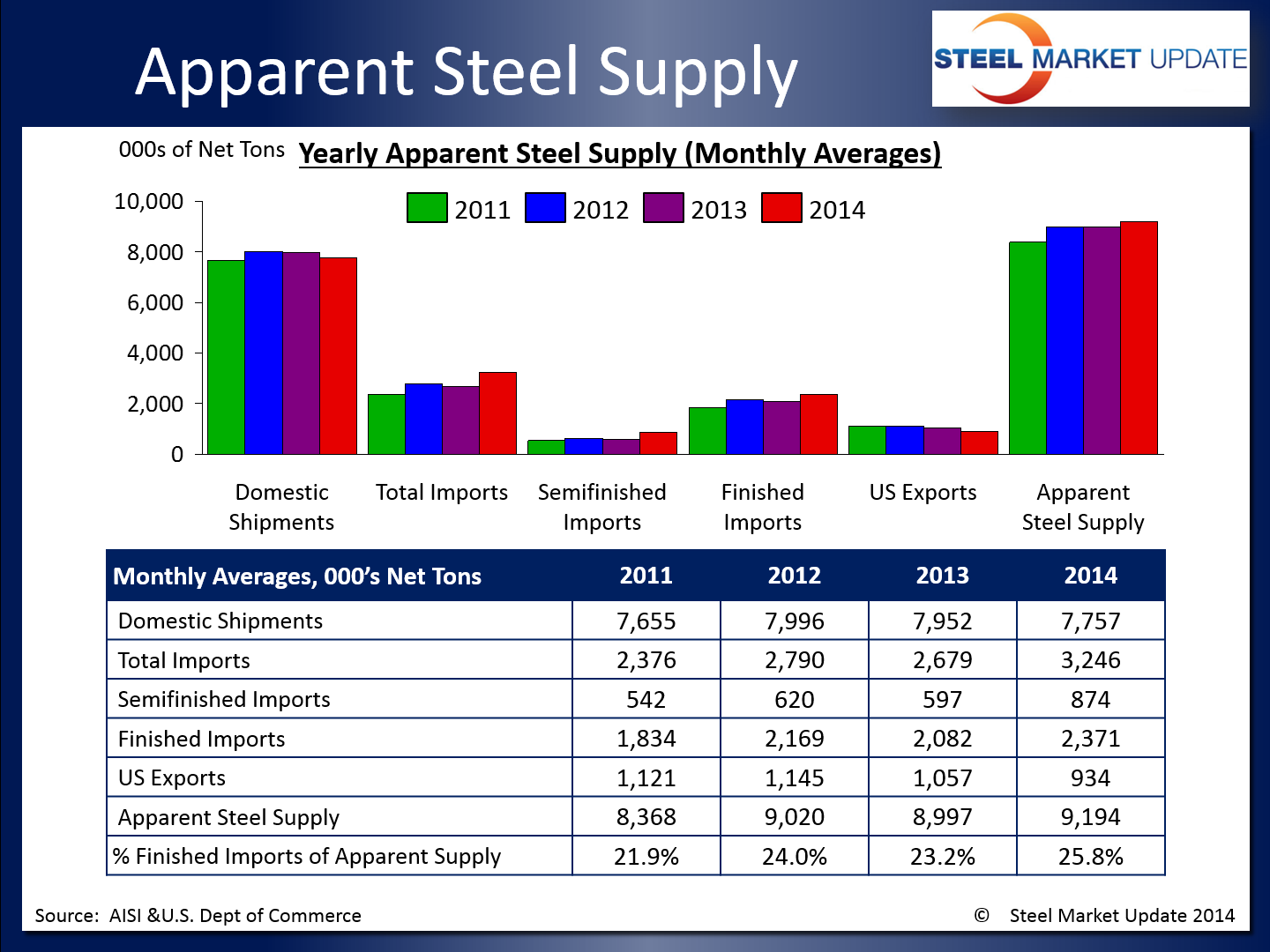

On a year to date basis, the 2014 YTD averages are very close to what we saw during in the previous two years, if not slightly higher for certain data points, and significantly higher than 2011 averages.

SMU Note: You can view the interactive graphic below when you are logged into the website and reading the newsletter online. If you have not logged into the website in the past and need a new user name and password we can do that for you out of our office. Contact us at: info@SteelMarketUpdate.com or by calling 800-432-3475. If you need help navigating the website we would also be very happy to assist you.

{amchart id=”120″ Apparent Steel Supply- Domestic Shipments, Semi-Fin Imports, Exports}