Market Data

April 22, 2014

SMU Service Center Inventory Forecast – Hit February, Totally Blew March – What Happened?

Written by John Packard

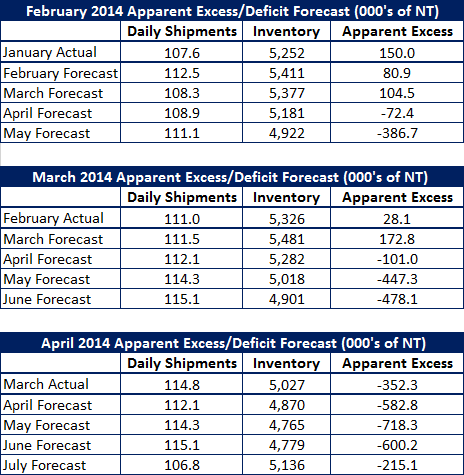

Once per month, Steel Market Update provides a flat rolled service center inventory forecast for our Premium Level members. We thought in light of the recent numbers released by the Metal Service Center Institute (MSCI) to see how our forecast for April compared with the actual figures compiled by the MSCI.

As indicated in our headline, SMU nailed the February forecast and then fell on our face in March. What happened?

The formula we used to forecast inventory levels, shipments, receipts, etc. certainly was not programmed to take into consideration the extreme weather the country had during February and March 2014. Second, we also did not predict production problems at AK Steel and two U.S. Steel facilities. Third, we saw pent up demand created by weather, trucking issues, etc. start to be relieved during the month of March.

Bottom line we forecast flat rolled steel inventories to end the month of March at 5.4 million tons and they came in at 5.03 million tons. The result was our forecast for excessive inventories of 172,800 tons ended up being a deficit of 352,300 tons.

How do we come up with our calculations as to whether or not inventory is in excess or deficit? We have predetermined that the perfect inventory balance for the flat rolled steel industry is 48 days worth of inventory. From there we determine whether or not inventories are balanced against that 48 day model and the result is either an excess or deficit in the inventory levels.

Below are the past two months worth of forecasts produced by Steel Market Update followed by our most recent forecast (April). We have made some adjustments to our model to take into consideration two things: mill outages and foreign steel arrivals. Those changes are built into our April 2014 forecast.

If our forecast is anywhere near correct (and we are still tweaking the formula to account for production issues as well as foreign arrivals and changes in demand) the domestic mills should be able to maintain or raise prices through July 2014.

We have been conservative with our foreign imports analysis increasing distributors’ inventories by 100,000 tons of flat rolled each month. We have also increased demand by 5 percent per month. We figure it will take a couple of months before steel flows out of US Steel, AK Steel and Essar Steel Algoma. So, we have factored that into our formula.

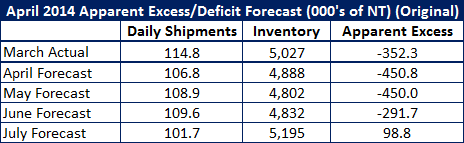

Without making those changes this is how our forecast would look:

We will see which one comes closer when we get into the second week of May.