Analysis

April 22, 2014

US Vehicle Sales and NAFTA Vehicle Production in March 2014

Written by Peter Wright

Light vehicle sales in the US rebounded strongly in March as the weather improved in the North and automakers increased incentives to reduce excess inventory. Light vehicles are cars and light trucks (GVW Classes 1-3, under 14,001 lbs.). The sales rate increased to 16.4 million units from 15.4 million units in February. The increase in light truck sales was particularly strong. Car and light truck sales achieved annual rates of 7.8 million units and 8.6 million units respectively. As a result, the light truck share of sales increased to nearly 53 percent, its highest share since mid-2011.

Moody’s Analytics expects vehicles sales to increase to a SAAR pace of nearly 17 million vehicle by year end and remain in that range in 2015 before coming down to a more sustainable pace in 2016. A pace of 17 million units incorporates the release of pent-up demand, which should diminish by 2016. Strong sales of vehicles assembled in North America reduced the off shore import market share to 22 percent, the lowest level since 2006.

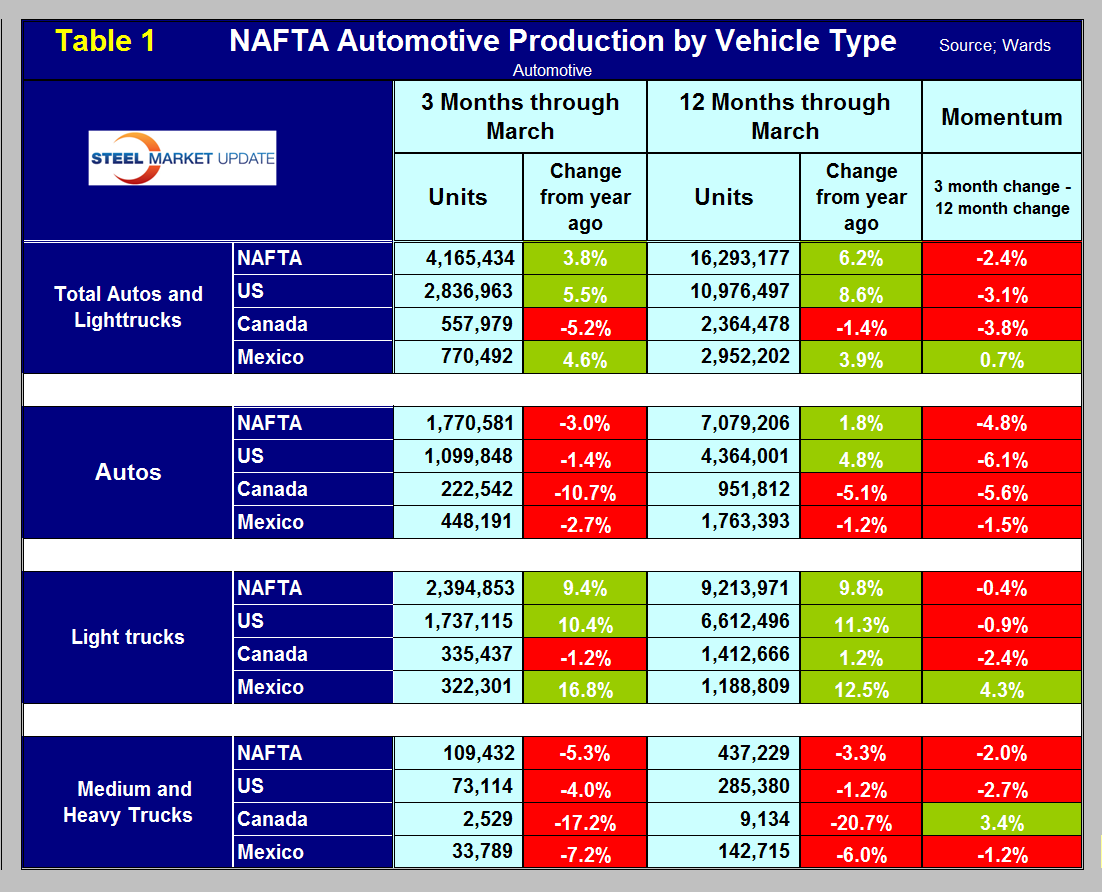

Light vehicle production in NAFTA increased by 7.0 percent in March to an annual rate of 17.794 million units. The US, Canada and Mexico grew by 6.9 percent, 2.1 percent and 11.4 percent respectively. It’s too soon to tell if this is the beginning of a trend, the first quarter results year over year are not so stellar. Table 1 shows the growth of autos, light trucks and medium and heavy trucks on a quarterly basis and a rolling 12 months year over year. Compared to Q1 2013, the production of autos and medium and heavy trucks declined in all three nations in Q1 2014. The production of light trucks increased in the US and Mexico but declined in Canada.

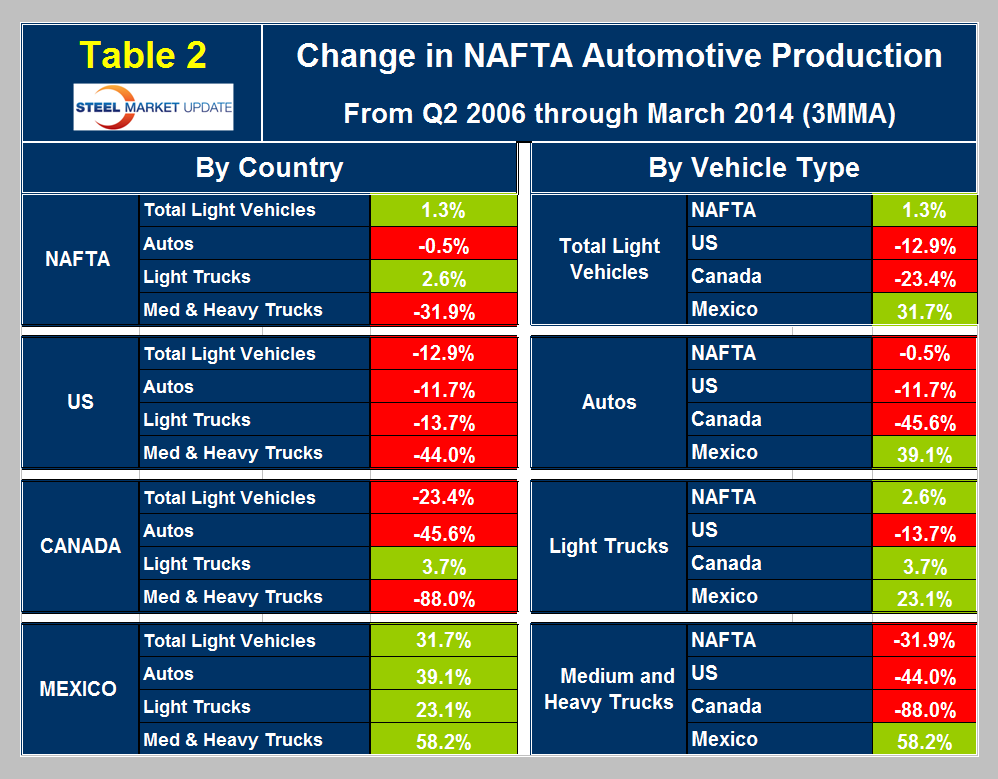

Total light vehicle production in NAFTA is now 1.3 percent higher than it was in the pre-recessionary peak of Q2 2006 but there is a big difference between the recoveries of the three nations. The US is still down by 12.9 percent, Canada by 24.4 percent as Mexico is up by 31.7 percent, (Table 2).

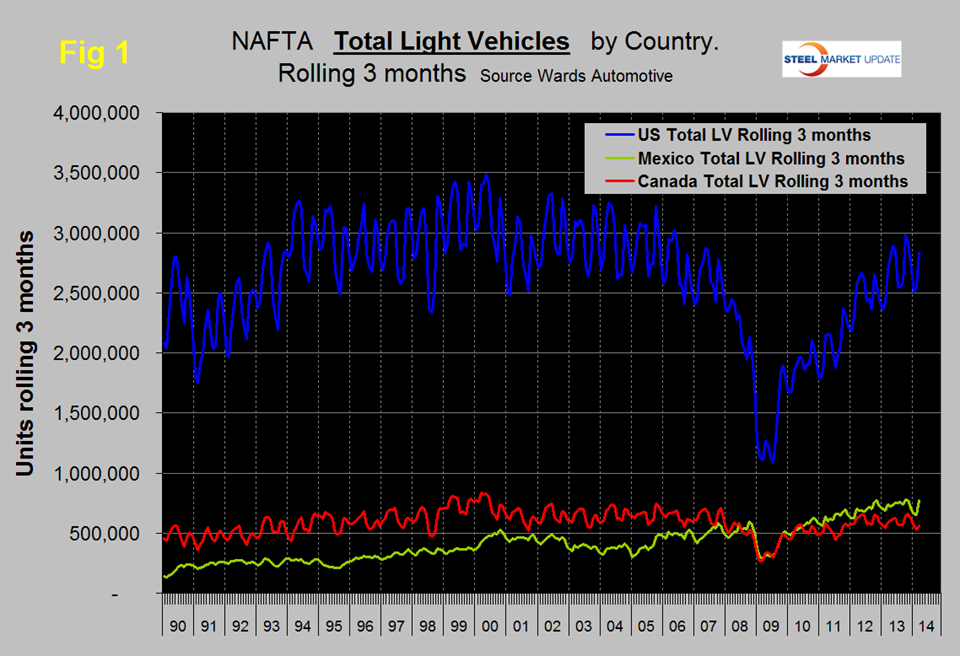

The evolution of the current balance of production in NAFTA is very interesting and does not seem to be reported elsewhere. Total production of light vehicles was hit by about 50 percent in all three countries between the end of 2008 and mid-2009, (Figure 1).

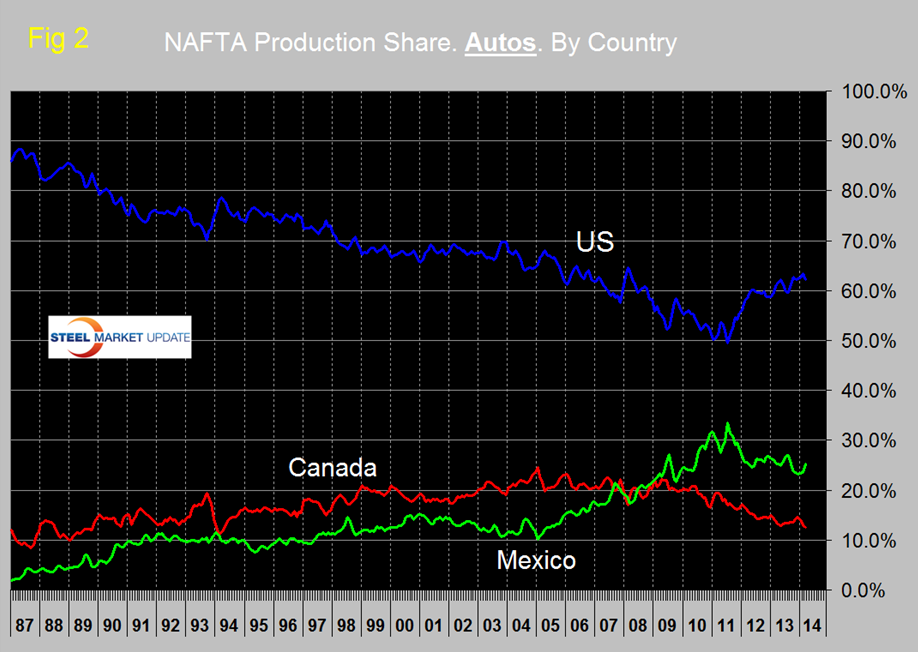

The production share of all three countries was unchanged through the recession as all countries were similarly affected. However, in the last three years there has been a strong swing towards auto production in the US at the expense of both Canada and Mexico, (Figure 2).

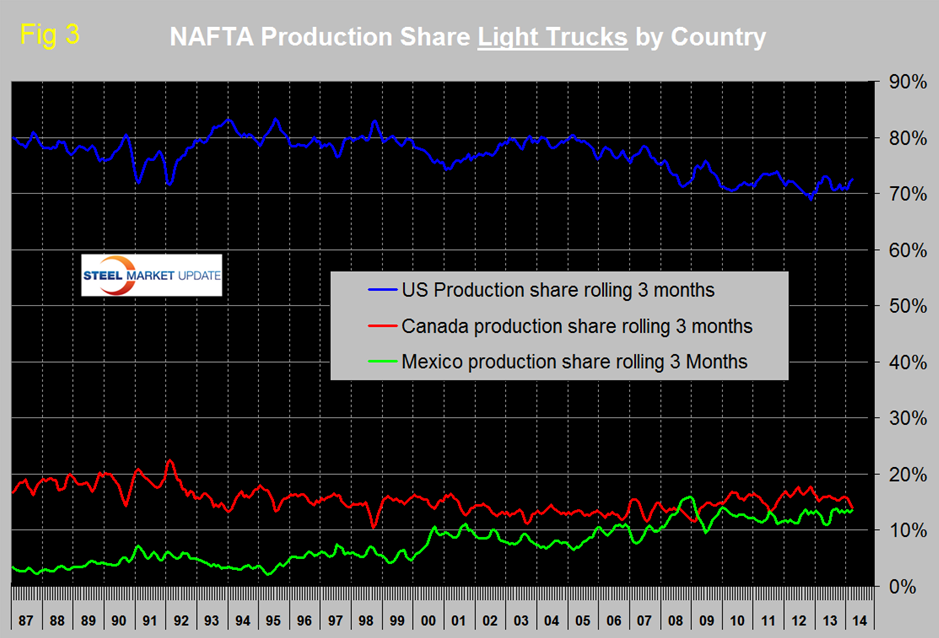

In the case of light trucks, there has been little if any change in share in the last few years, (Figure 3).

The Dayton Daily News reported on April 7: “Auto manufacturers have poured nearly $1.8 billion into Ohio plants recently, adding jobs in an industry that employs 21,000 Ohioans and is rebounding from big losses during the Great Recession. Experts attributed the new investments to several factors — increasing demand from consumers, recent union contracts, and streamlined manufacturing and distribution processes that make it more cost-effective to produce vehicles and parts in the state. The rebounding auto industry also benefits companies that produce and supply parts for the automakers, leading to additional jobs and investment.” More good news for US manufacturing.

Ward’s Automotive reported last week that the auto companies did succeed in reducing inventory in March, total vehicles available for sale fell to 62 days from 75 in February, almost back to the 60 days available in March last year. Days available for sale for the Detroit 3, the Asian manufacturers and the Europeans were 76, 52 and 49 respectively.