Prices

April 29, 2014

Final April Import Projection

Written by John Packard

Each week during the month Steel Market Update (SMU) checks the license data from the U.S. Department of Commerce regarding imports of foreign steel. Based on the data compiled each week we then project where we think imports will end up at the end of the month. April license data is suggesting we could see the largest influx of imports since before the beginning of the Great Recession.

The license data numbers are usually updated late in the day on Tuesdays. Based on the license data for the first 29 days of April, the expectation is imports will total approximately 3.5 million tons for the month of April. However, we projected 3.5 million tons for the month of March but when the Preliminary Census numbers came in the total was closer to 3.2 million than the 3.5 million tons.

We want to remind everyone that these forecasts are being provided as a way to watch trends in the import numbers and should not be used as an actual import total for the month of April.

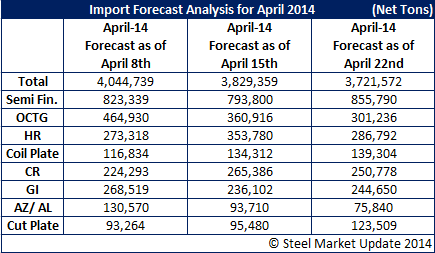

Our expectation is for total April imports to come in around 3.4 to 3.5 million net tons. As you can see by the table below the projected numbers on the total have shrunk as the month progressed. However, many of the individual items which we watch closely on our list have remained fairly constant.

As we look at various products we are seeing strong imports of slabs (semi-finished) which have consistently been running around 800,000 net tons. Semi-finished imports are products which do not go directly to consumers but rather to the domestic steel mills such as NLMK USA, California Steel, AM/NS Calvert and AK Steel. For your information, the twelve month moving average on semi-finished is 676,867 net tons and the three month moving average is up to 842,170 net tons (through March).

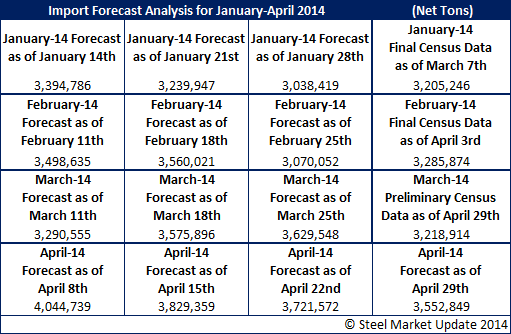

We thought our readers might enjoy taking a look back to see how our weekly projections do when compared to the final monthly numbers. As you can see the last January projection was less than the 3.2 million tons actually received. February imports we had the same scenario and then March went the opposite way (projected much more than what was actually received).