Prices

May 13, 2014

May Steel Import License Data

Written by Brett Linton

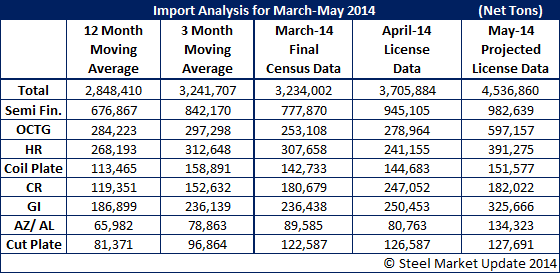

The U.S. Department of Commerce released their latest imported steel license data for the month of May 2014. The early indication is for May steel imports to remain at, or above the projected April imports of 3.7 million tons. March final imports came in at 3.2 million which is also our 3 month moving average.

The actual projection based on the first 13 days of data for the month of May comes to 4.5 million net tons. However, we are finding the first couple of weeks of the month tend to be over-stated by the time the month comes to a final resolution. Last month (April) the second week of the month the license data suggested the month would be 3.8 million tons. Preliminary census numbers for April won’t be available for a couple of weeks and the number could move lower from the 3.7 million ton level we are seeing right now.

None-the-less, the 4.5 million ton license rate is the highest we have seen since we start keeping track of imports on a weekly basis.

The numbers that jump out at us are: OCTG (oil country tubular goods) which at the moment are double what was already a high number. Hot rolled is also much higher than normal as is galvanized and Galvalume. We will need to watch these numbers carefully as they could impact lead times and pricing if they were to continue at this level.

SMU Note: May numbers are based on license data through the 13th of the month and then we project the final monthly number based on the average daily license rate. We are not projecting imports to be as high as the license data is currently indicating as we have seen the numbers drop back in previous months. Even so, our expectation is for May to be a very high number and, once again, eat into the percentage of apparent steel supply held by the domestic steel mills.