Prices

June 10, 2014

Tidal Wave of Imports Continues: South Korea Leaps Over Canada as #1 Exporting Country

Written by Brett Linton

We are now one-third of the way through the month of June, far enough along to begin doing our analysis of the US Department of Commerce license data on imports. The data is showing us that the surge of imports grew during the month of May and will continue into the month of June. We did a special analysis of South Korean oil country tubular exports which flooded the U.S. market in May and appear poised to do the same in June. Korea is slated to be the biggest exporting country of steel goods to the United States during the month of May behind Canada. Total South Korean exports are about to exceed 500,000 net tons for the month of May.

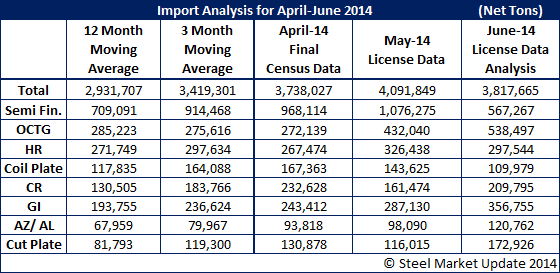

First, let’s take a look at the May import numbers for all steel products which we now believe will meet or exceed 4.0 million net tons. The latest license data has the number at 4,091,849 net tons as of today (June 10th).

At first look, the June license data is showing a continuation of the surge in foreign steel with the data suggesting an import number in excess of 3.5 million tons.

To put this into perspective:

Business conditions this year are perhaps up 3-6 percent as an average. Some industries are reporting business conditions as being flat while others are up by as much as 8 percent.

Last year at this time the 12 month moving average for imports was 2.63 million net tons. The difference between last year and this year is 2014 imports are up 14.1 percent.

Last year at this time the 3 month moving average for imports was 2.68 million net tons. Last year the trend for imports was relatively stable as shown by the 3MMA compared to the 12MMA. In contrast, this year’s import 3 month moving average is 3.419 million net tons or up 35.8 percent compared to one year ago.

Looking at total imports from last May were 2.84 million net tons and the expected difference being 44.2 percent or 1.25 million tons more this year than last.

Semi-finished steel last May was 664,000 net tons and had been climbing from the previous two months. Semi-finished imports this year for May are expected to exceed 1 million net tons. Semi’s are forecast to be up 62.1 percent in one year.

There has been a lot of press about oil country tubular goods. The South Koreans are helping make the domestic mill’s case as their OCTG shipments to the United States are beyond comparison. The May data indicates that South Korea will have exported over 200,000 net tons during that one month alone. June data is pointing to another big month for South Korean OCTG exports. Last May South Korea shipped 64,255 net tons and the entire world shipped 243,483 net tons.