Prices

July 22, 2014

July Import Licenses Trending Toward Big Steel Import Month

Written by John Packard

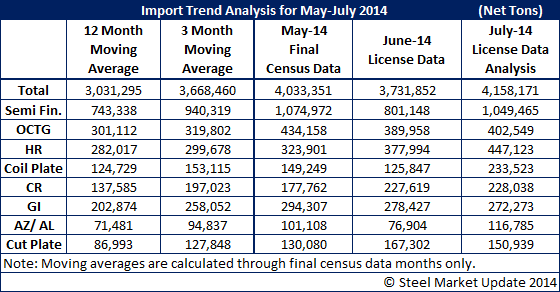

The US Department of Commerce released steel import license data through the first 22 days of the month of July. The most recent license data supports our belief that steel imports will meet or exceed the 3.7 million net tons reported for June and could meet or exceed the 4.0 million net tons received during the month of May 2014.

Once again semi-finished (mostly slabs) could well reach 1 million net tons for the month. The domestic steel mills are the importers of foreign slabs as well as a portion of the hot rolled imports. The two largest exporting countries are Brazil and Russia.

Hot rolled appears to be poised to exceed 400,000 tons in July. This would be higher than both May and June numbers and well above the 12 month moving average (12MMA) of 282,017 net tons. The largest exporting countries on HRC are Korea and Russia with Japan and now Italy coming growing suppliers.

Coiled plate needs to be considered at the same time as hot rolled and we are seeing much higher imports of license requests for July. At this moment it appears coiled plate imports could exceed 200,000 net tons. The 12MMA is 124,729 net tons. The largest exporting country for coiled plate is Russia followed by Canada, the Netherlands and then Korea.

Cold rolled imports are looking like they will be close to the June numbers which exceeded 200,000 net tons. The 12MMA on CRC is 137,585 net tons. The biggest exporting countries are China, Canada, Korea with the United Kingdom beginning to ship more product to the U.S.

Galvanized imports are looking like they too will come in close to the May and June numbers exceeding 250,000 net tons and exceeding the 12MMA of 202,874 net tons. The largest exporting countries are China, Korea and then Canada and Taiwan.

Other metallic imports, most of which is Galvalume, look like they could very well meet the May tonnage totals which were just over 100,000 net tons. Taiwan is the biggest exporting country followed by Korea and China.

Oil country tubular goods (OCTG) continue to be quite high and are expected to be in the uppers 300’s net tons or about where they were last month and just below the May high of 434,158 net tons. South Korea is the largest exporter, 8.3 times greater than the second place country Mexico and 8.6 times more than Canada.