Prices

August 26, 2014

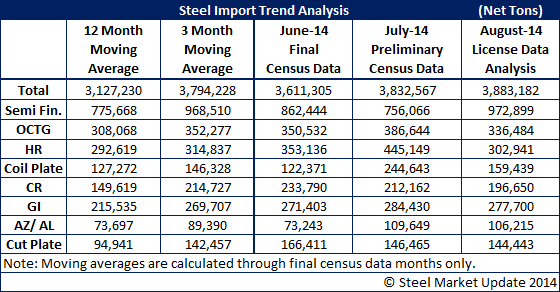

August License Data Pointing Toward 3.8 Million Ton Month

Written by John Packard

Since last week licenses for foreign steel to be imported into the United States during the month of August have retreated slightly and the latest data is now leaning toward import levels to be very close to the just released Preliminary Census number for July of 3.8 million net tons.

At this moment, and I warn our readers that we are somewhat skeptical of relying on license data for specific totals and only using the data as an indicator of the trend for the month. A good example is for the first three weeks of the month the trend was pointing toward a 4.0 million net ton month and now the trend is slightly lower.

Semi-finished steels continue to be on the high side as we expect slabs to reach somewhere between 900,000 and 1 million net tons.

OCTG continue to point toward a mid 300,000 net tons level which would be in line with June and July but above the 12 month moving average.

Hot rolled is trending toward the 12 month moving average of approximately 300,000 net tons.

Cold rolled appears will be down slightly from June and July levels. Even so, the Chinese cold rolled numbers appear will be close to their highs achieved in June. The Chinese are the largest exporter of cold rolled to the United States followed by a distant Canada.

Galvanized imports are trending toward exceeding the 12MMA and appear will be very similar to June and July levels.

Galvalume imports are exceeding both the 12MMA and 3MMA and should be close to July levels which exceeded 100,000 net tons.

Here is a table showing how August imports are trending: