Prices

October 28, 2014

Where Are the Flat Rolled Steel Price Increases?

Written by John Packard

This article was written just prior to the AK Steel announcement of a $20 per ton price increase which we received after 5 PM this afternoon.

Steel Market Update reported in a recent issue (SMU Oct. 23rd) recently that this is the time of the year that the domestic steel mills traditionally move to stem the slide in flat rolled steel prices by announcing new flat rolled steel price increases. So, we are being asked why haven’t steel prices moved already and when will the mills make their move?

![]() We have no direct line into the thinking of the domestic mills. We can only report on what we are seeing out of our steel buying contacts and compare that against history.

We have no direct line into the thinking of the domestic mills. We can only report on what we are seeing out of our steel buying contacts and compare that against history.

Steel buyers were reporting the domestic steel mills as being actively pursuing new orders as they push to fill out their 4th Quarter 2014 order books. SMU is being told that lead times continue to be reasonable to slightly short and many orders are being produced prior to their promise dates, which is causing some back-up in either deliveries or non-planned growth in inventories. Our Premium level members who reviewed our most recent survey results should have noticed that our service center inventories took the highest one month jump and are at the highest level we have recorded from our survey at 2.44 months.

Demand continues to be quite good as described by one service center executive who reported to SMU earlier today, “There are a lot of customers who are looking to buy a chunk of steel right now.” He went on to say that his company was recommending now as being a good time to take advantage of the slide in pricing. “The mills are super aggressive for business,” is what he told us.

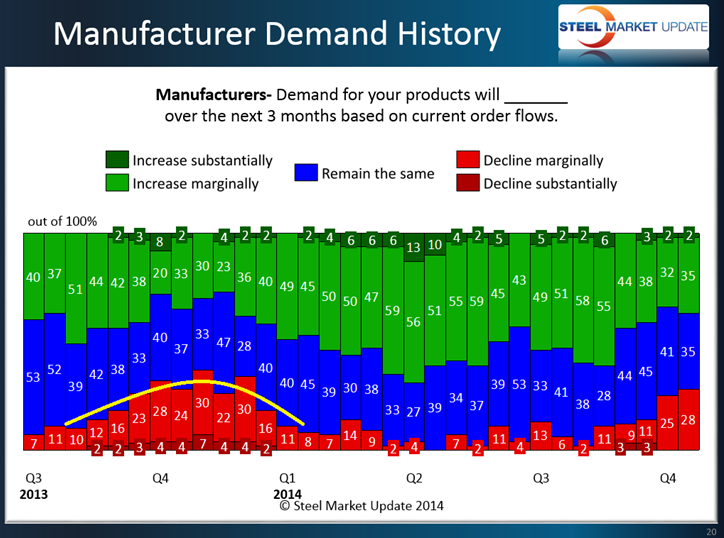

Steel Market Update picked up some weakening in demand during last week’s flat rolled market survey. However, when comparing it against historical trends and doing some channel checks we believe that the weakening in demand is nothing more than normal seasonal adjustments (see graphic below). The one market where we are seeing a true weakening of demand is in the Agricultural (Ag) markets where we are being advised that the downturn could last a couple of years (after coming off a number of record years).

Many buyers do not believe the timing is quite right for the mills to redirect prices in the form of an announced price increase. We heard from many buyers who told us essentially the same thing as what we heard from a wholesaler this morning, “The rumor is out there [regarding a possible price increase], but when I bring it up no one owns it. Mill order books are not full enough to warrant or risk an announcement. Inventories are not lean…imports still coming and raw materials moving down. I just don’t see it [price increase] yet.”

Another large service center purchasing manager out of the Midwest pointed at the changes in supply and demand fundamentals as one of the basic reasons behind what is driving steel prices right now. He told us, “…the change to fundamentals is the growth in distribution inventory. This reflects the shift that began in June for increases in supply. This had domestic outages being solved and import arrivals continuing to grow. Import arrivals of coils should begin to step down with the close of navigation (while some Russian deliveries may be pulled forward offsetting this somewhat). New orders for imports slowed considerably in August. Most Chinese imports sales stalled as there was too much risk for the importers, and the HRC forward curve showed a much smaller spread (this is how buyers should compare import deliveries 3 month forward).”

Even so that same purchasing manager told us, “This is the season for price increases. [This is] Usually the transparent plan to affect contract discussions. …The price increases are the standard response to an unwinding market. We have both elements in play. AK has traditionally followed a pattern selling aggressively to fill a particular delivery period, then announcing an increase when they have created time to wait before they have to fill the next period – hoping the increase is accepted.”

So, the question SMU is being asked is where are the price increases? The answer is tied to where the mills are with lead times. Traditionally, as lead times start heading into the next calendar year the announcements start coming (or just prior to the December books closing in an effort to finish off the year quickly and concentrate on contract negotiations).

Complicating the issue are those pesky imports which could set a record this year for the most imports ever seen during a calendar year. The second issue is the decline in scrap pricing. At the time of this writing SMU was gathering information from our scrap sources which are pegging the scrap decline for November as potentially being $20 to $30 per gross ton. This is higher than the $10 to $20 being discussed at the end of this past week. Lower scrap prices usually lead to lower spot pricing.

As we have pointed out, and one of our buying sources has as well in his commentary above, this is the time of the year the mills announce price increases. That is by no means a guarantee it will happen soon just that buyers should not be surprised when it does happen.