Prices

December 5, 2014

A Note to our Galvanized Readers

Written by John Packard

Steel Market Update publisher, John Packard, spoke to the Heating, Air-conditioning, Refrigeration Distributors International (HARDI) conference this afternoon. Many of the HARDI wholesalers and associated companies are involved with galvanized sheet and coil steels.

As SMU prepared to speak to the group we realized that many times the industry references benchmark hot rolled prices and not galvanized prices when speaking about the industry. We thought it would be helpful to the HARDI wholesalers as well as others associated with the steel industry if we provided some guidance as to how to translate hot rolled coil pricing to a galvanized base price.

Hot rolled coil (HRC) prices can be referenced in either dollars per ton ($/ton) or by hundredweight (cwt). The financial community, industry publications and the steel mills themselves tend to use dollars per ton when speaking about HRC prices.

Steel Market Update’s most recent hot rolled price average is $620 per ton ($31.00/cwt) and most of the other indices are very close to the SMU number as well.

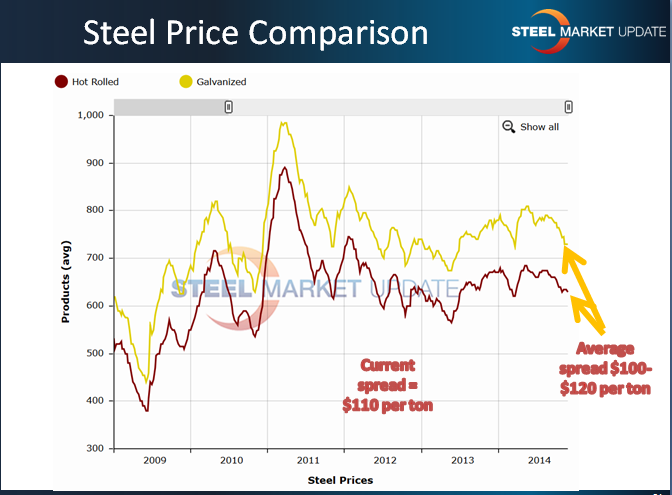

Historically, the spread between hot rolled coil base pricing and that of cold rolled and coated (galvanized) are $100 to $120 per ton ($5.00/cwt to $6.00/cwt).

Our galvanized average is currently $730 per ton ($36.50/cwt base) which is $110 per ton above our $620 hot rolled number ($31.00/cwt base).

Over the past two years (January 2013 until this week) hot rolled has averaged $641 per ton while galvanized base prices have averaged $751 per ton ($110 per ton spread).

When business is weak we tend to see the spread shrink to $100 per ton and when it is quite strong the spread expands to $120 per ton. At $110 per ton over the past two years we seem to be in a Goldilocks zone – not too hot and not too cold – just about right.