Analysis

December 5, 2014

Final Thoughts

Written by John Packard

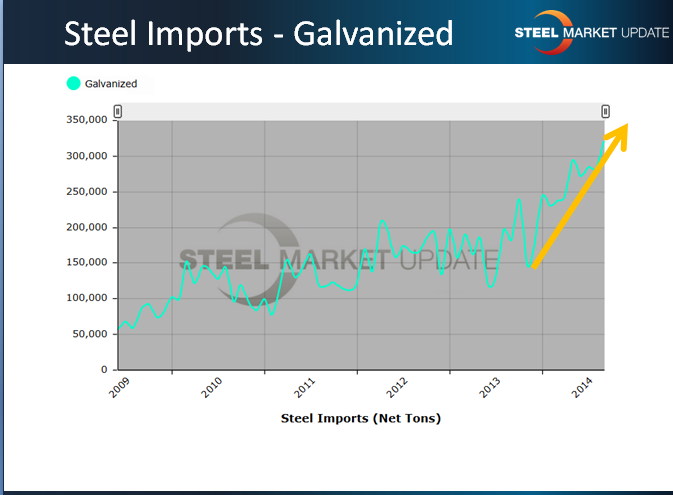

Part of my talk at the 2014 HARDI conference was regarding galvanized imports which reached 325,000 net tons in October and appear will be approximately 300,000 tons when the November Census Data numbers are released later this month. To put this into perspective, at this point last year the U.S. received 150,000 net tons and the average for 2013 was closer to 175,000 tons per month. The 300,000 ton level is quite high when you consider that The Techs three galvanizing lines when running full are about 80,000 tons per month. It takes quite a few galvanizing lines to equal 300,000 tons.

This is what galvanized imports look like over the past few years. The domestic mills have to be concerned. Is this one of the reasons why ArcelorMittal decided to close their number 2 galvanizing line at Indiana Harbor West?

Alan Beaulieu of the Institute for Trend Research (ITR) is the HARDI economist with an exceptional record of accuracy. So, it was interesting to hear him forecasting a “Great Recession” to hit the world by 2030. I will write more about this in the days to come.He did mention that baby boomers will come out of this alright (end of our rope), Gen-X will be the worst hurt and Millennials could do very well if they do things ahead of time to prepare.

Over the short term ITR is forecasting a slight slowdown during the first 6 months 2015 before picking up during the second half of the year. Mr. Beaulieu will speak again tomorrow so I hope to write more on his comments on Tuesday evening.

I am in San Antonio where I spoke to the HARDI wholesalers, manufacturing companies associated with HARDI and others interested in galvanized steel. Steel Market Update was spoofed by the speaker just before I went on. The speakers had been asked to keep our presentations free of advertising for our companies. So, Tim Quinn of Majestic Steel was speaking about the consolidation of the steel industry and after he began his talk he removed his jacket. He then mentioned to the group that the speakers had been asked to forgo “shameless self-promotion.” He then proceeded to turn around so that the assembled crowd could see the Steel Market Update name across the back of his shirt. A good laugh was had by all.

Our training workshops were mentioned a number of times during the HARDI conference. There are a number of companies here who have had employees attend our Steel 101 workshops and are doing very well within their company. We encourage anyone who would like to learn more about how steel is made, rolled, qualities produced, bought and sold and market influences that affect pricing and sales. Our next workshop is coming up in January. It will be held outside of Charleston, SC on January 20 & 21, 2015. A tour of Nucor Berkeley is part of our program. You can find out more on our website: www.SteelMarketUpdate.com.

I will be in San Antonio through Tuesday of this week returning to the office for one day (Wednesday) before leaving to conduct our special sales training workshop at a service center in Louisiana.

As always your business is truly appreciated by all of us here at Steel Market Update.

John Packard, Publisher