Prices

December 9, 2014

Final October Imports at Record Levels, Up 43% Year Over Year

Written by Brett Linton

Total October steel imports were recently finalized by the US Department of Commerce at 4,441,271 net tons (4,029,058 metric tons), surpassing the previous high of 4,417,811 tons in August 1998. October had been on pace to be a high tonnage month, but previous preliminary data figures were a few thousand tons shy of breaking the 16 year record (one reason why we try to represent license data figures as a way of watching trends but there is some “slop” in the numbers which can go in either direction).

Based on license data (remember our “slop” comment above) November steel imports appear will be close to 4.0 million net tons. This is a little higher than the 3.7-3.8 million tons we had been projecting over the past couple of weeks.

October imports are up 13.9 percent from the 3,900,123 tons imported in September. Compared to the same month in 2013, October tonnage increased by 43.2 percent.

Semi-finished imports were 984,827 tons in October, up 5.5 percent from the previous month and 21.5 percent higher than levels seen last October.

Imports of oil country tubular goods (OCTG) declined 1.6 percent from September to October to 317,573 tons, and were down 19.9 percent from levels one year ago.

Hot rolled imports at 499,646 tons were the highest seen since May 2006 when they reached 572,631 tons. They are up 24.1 percent compared to last month and up 109.0 percent compared to one year ago.

Imports of cold rolled products at 285,550 tons were the highest seen since December 2006 when they were 289,938 tons. Cold rolled imports increased by 2.3 percent compared to last month and 101.5 percent from the same month one year ago.

Galvanized imports at 344,989 tons were the highest seen since October 2006 when they were 362,825 tons. October galvanized imports increased by 7.6 over September and were up 44.3 percent over October 2013 levels.

Imports of other metallic coated products rose 29.9 percent from September to October to 94,561 tons, a decrease of 4.1 percent from levels one year prior.

Plate in coil imports increased 37.4 percent month over month to 253,510 tons, up 161.5 percent from the same month last year.

Imports of plates cut lengths were 191,947 tons, up 5.5 percent from September imports and up 134.1 percent from October 2013 tonnage.

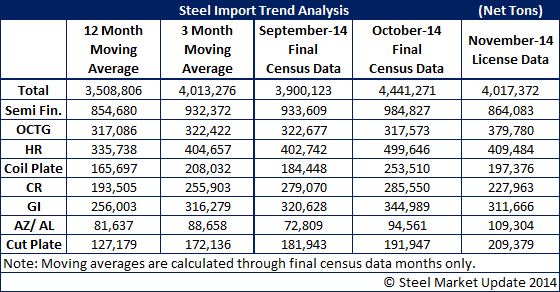

The table below shows a comparison of September, October, and November tonnage to the three month moving average (3MMA) and 12MMA. Note that the moving averages are through final October figures only.

Below is an interactive graphic of our Steel Imports History by Product, but it can only be seen when you are logged into the website and reading the newsletter online. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”105″ Steel Imports- All Products, Final Data by Month}