Prices

January 6, 2015

Updated December & Year to Date Steel Import Numbers & Analysis

Written by Brett Linton

Today we are producing two foreign steel import reports. This one is our normal report and we have a second one following which will look at imports from a different view point. The second report also addresses both long and flat rolled products and is normally available only to our Premium level members.

The U.S. Department of Commerce updated the December foreign steel import license data this afternoon. Based on the latest numbers it appears December will come in around 3.5 million net tons or only slightly below November’s 3.6 million net tons. SMU publisher has some comments about the license data numbers in our Final Thoughts this evening. You may want to review them as we always want to note that license data numbers can vary from the Final Census numbers.

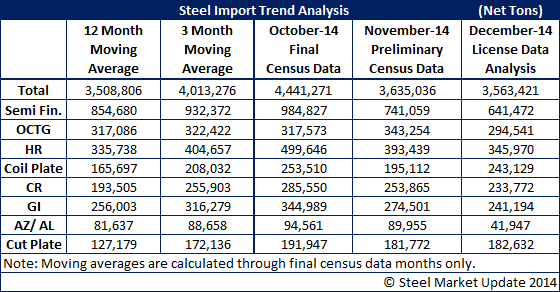

OK. Having said all of that lets do a quick review of what we are seeing, first the December number appears will be in line with the 12 month moving average (12MMA) and below the 3 month moving average (3MMA). The 3MMA being so high due to the 4.4 million net tons landing in the U.S. during the month of October.

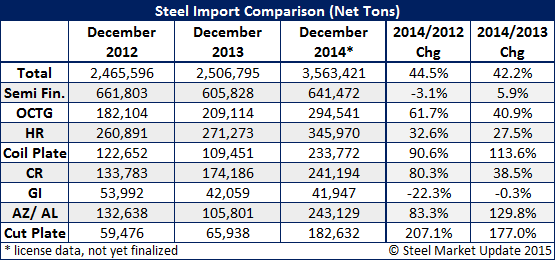

Comparing December 2014 against the previous two years we find that this year is up 44.5 percent over December 2012 and 42.2 percent above December 2013. As you look at the table below you get a better sense as to what items have been surging this year over the past two years: OCTG, coiled plate, hot rolled, cold rolled, Galvalume (other metallic) and cut plate. Semi-Finished (mostly slabs) and galvanized were close to what we saw the previous two years.

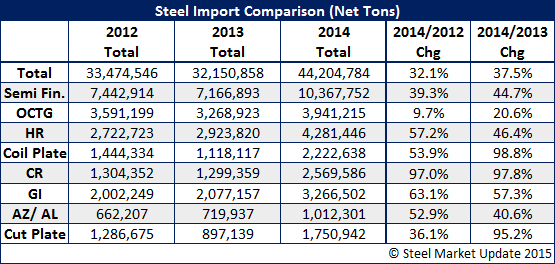

We also thought our readers would be interested in taking a look at where we “think” the final numbers will be when the final census numbers are released. As we have mentioned previously, at 44 million net tons 2014 would be the second largest foreign steel importing year in history. You can review the totals for the year below and see how much greater 2014 has been in each product vs. where that product was during 2012 and 2013.