Prices

May 7, 2015

March Apparent Steel Supply Down 1.8% YOY, Up 6.8% Over February

Written by Brett Linton

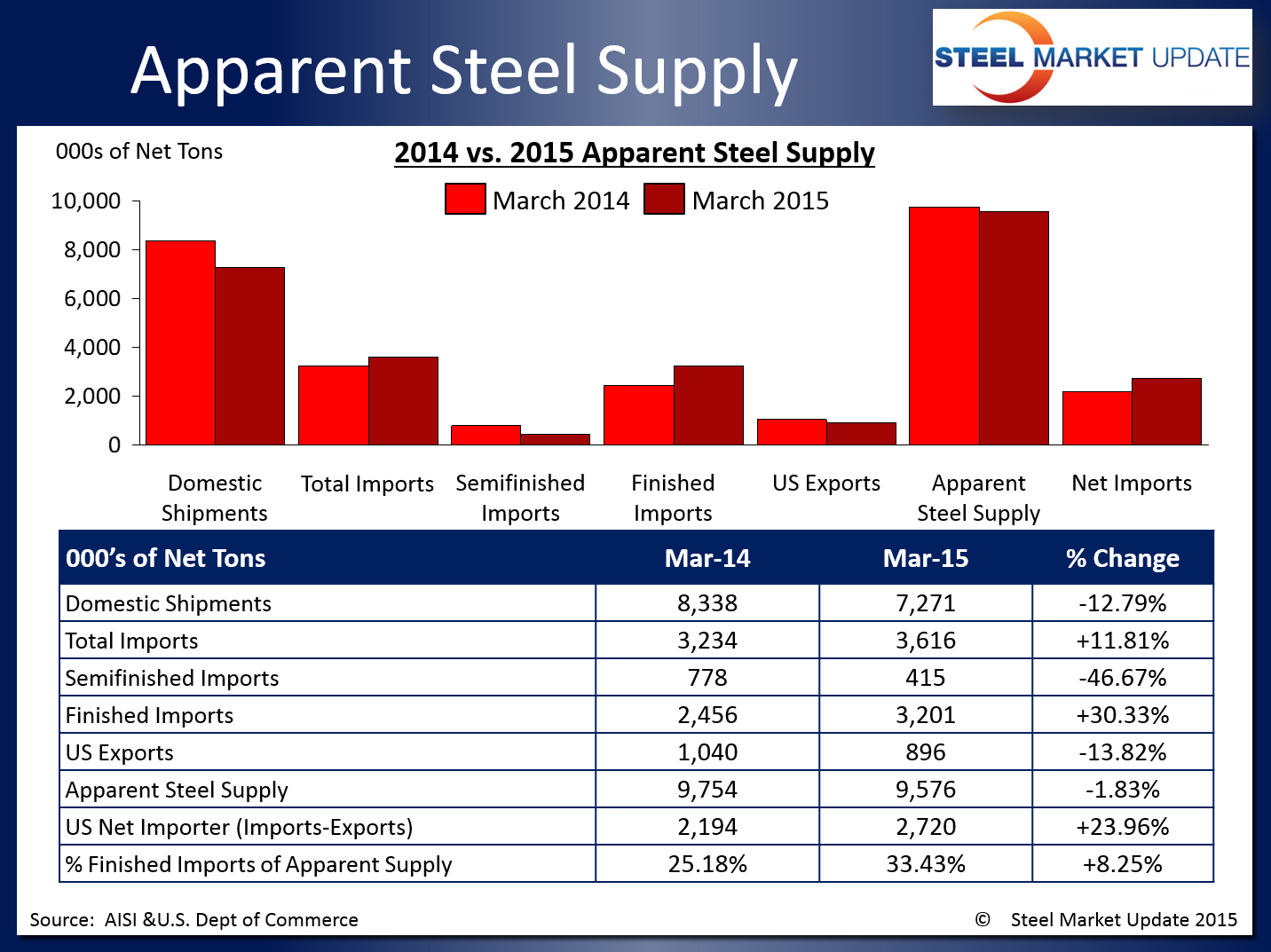

According to the latest data released from the US Department of Commerce and the American Iron and Steel Institute, apparent steel supply for the month of March 2015 is 9,575,903 net tons. Apparent steel supply is calculated by adding domestic steel shipments and finished US steel imports and subtracting total US steel exports.

March supply represents a 178,051 ton or 1.8 percent decrease compared to the same month one year ago. Although finished imports increased 745,005 tons (30.3 percent) and exports declined 143,729 tons (13.8 percent) during this period, it was all negated by a 1,066,785 ton (12.8 percent) drop in domestic shipments. The net trade balance between imports and exports was a surplus of 2,719,933 tons in March, an increase of 24.0 percent from March 2014 data.

SMU Note: Our Premium Level apparent steel supply analysis goes into more detail as we provide data on apparent steel supply for flat and long products. We plan to publish this analysis in the next few days.

When compared to last month when apparent steel supply was at 8,968,831 tons, March supply increased by 607,072 tons or 6.8 percent. The month over month increase is mostly attributed to a 345,197 ton or 5.0 percent increase in domestic shipments and a 279,243 ton or 9.6 percent increase in finished imports. Exports were up slightly at 2.0 percent.

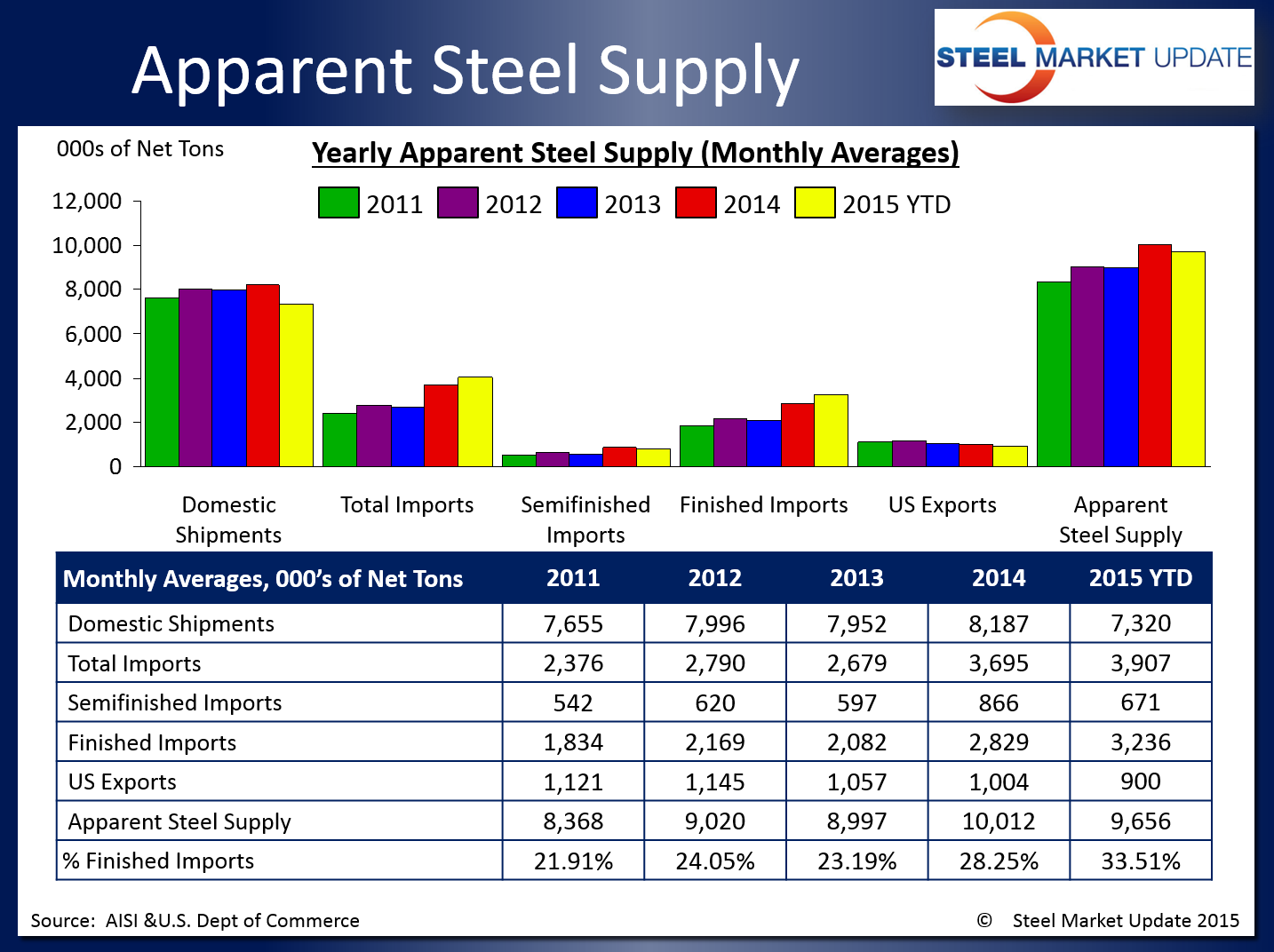

On a year-to-date basis, the 2015 averages are mixed in comparison to previous years. Since the 2015 averages are only based off of three months, and the previous years are over the entire year, the graphic below should be take with a grain of salt until we get further into 2015.

You can view the interactive graphic of our Apparent Steel Supply history below when you are logged into the website and reading the newsletter online. If you need help accessing or navigating the website, don’t hesitate to contact us at info@SteelMarketUpdate.com or 800-432-3475.

{amchart id=”120″ Apparent Steel Supply- Domestic Shipments, Semi-Fin Imports, Exports}