Prices

May 13, 2015

Net Imports of Sheet Products through March 2015

Written by Peter Wright

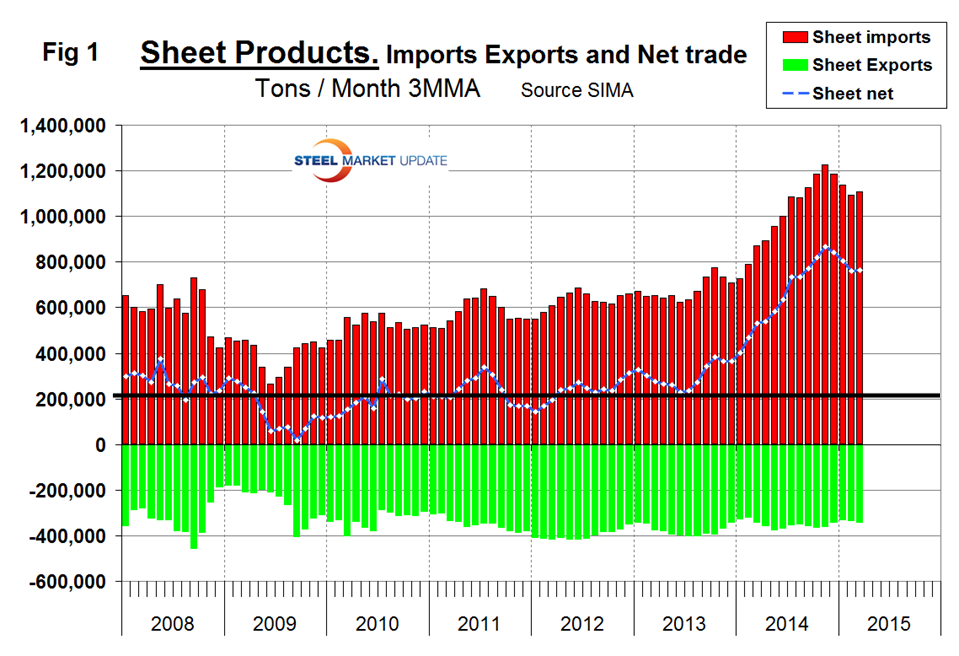

Net imports equals imports minus exports. We regard this as an important look at the overall trade picture and its effect on demand at the mill level. Figure 1 shows that net sheet product imports on a three month moving average (3MMA) basis in March continue to be almost double that which existed before the recession.

The deterioration in net was almost entirely an import effect, exports have been fairly consistent though drifting down slightly since Q2 2012. Table 1 shows net imports by product.

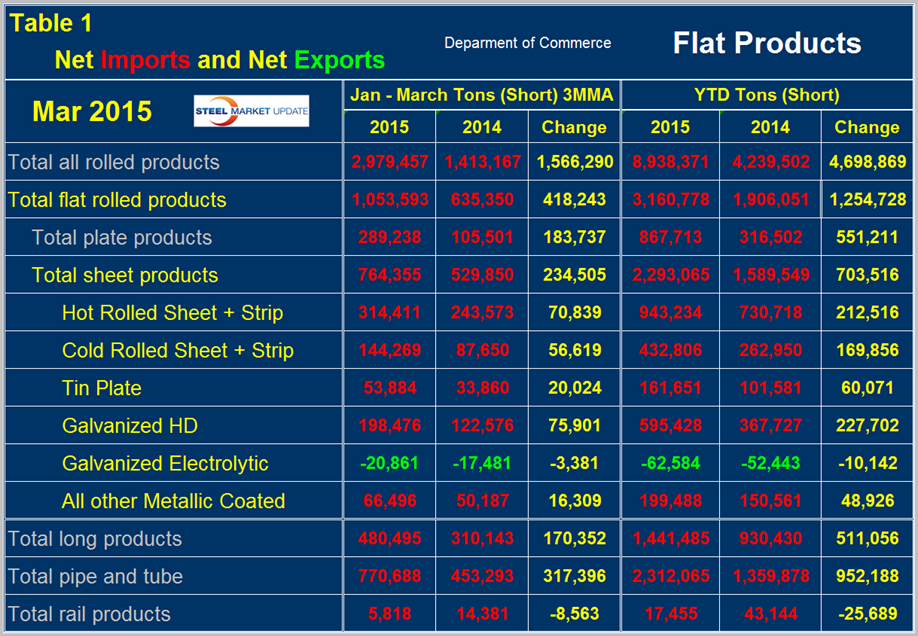

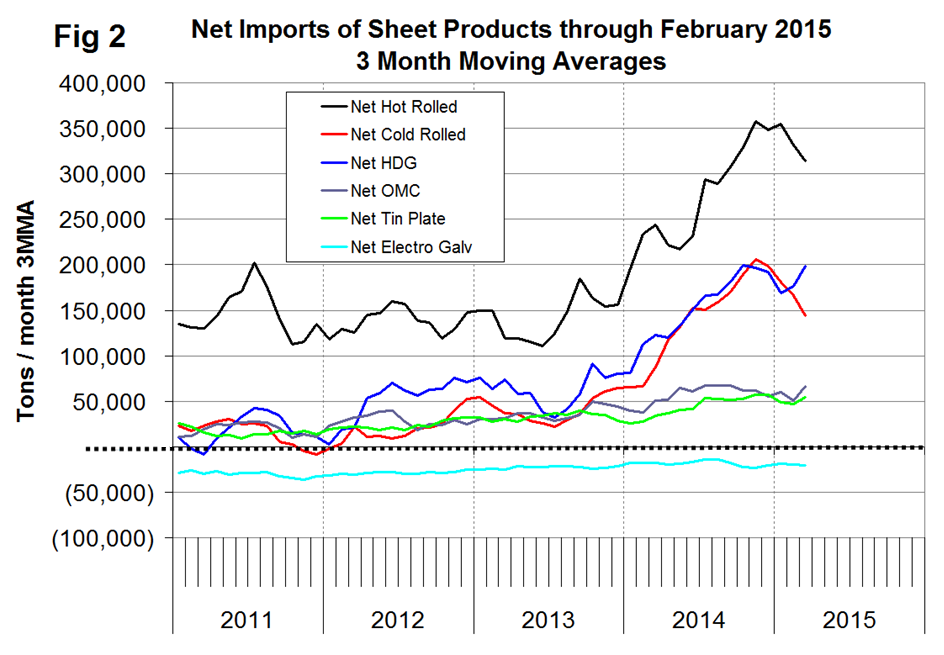

Year to date through March, total net flat rolled imports were 3,160,778 tons of which 2,293,065 tons were sheet products. On a 3MMA basis January through March net sheet imports increased by 234,505 tons year over year. The 3MMA of net imports increased on all products except electro-galvanized and rail which were down slightly. Electro-galvanized was the only product to have a trade surplus in 2013 and 2014 and this continued into 2015. In Table 1 negative net imports (which means a trade surplus) are shown in green. Figure 2 shows the trend of monthly net sheet product imports since January 2011 on a 3MMA basis. Hot and cold rolled net imports have been declining since Q4 last year but HDG increased in both February and March. The trade surplus of electro-galvanized has been fairly constant for the last five quarters.