Prices

June 7, 2015

April Steel Exports Down 21.8% Compared to Last Year

Written by Sandy Williams

Exports of steel out of the United States to the rest of the world fell in April according to the latest data released by the US Department of Commerce.

In a press release the American Institute for International Steel (AIIS) reported U.S. steel exports fell 8.5 percent in April after making a slight gain in March. Compared to April 2014, exports were down 21.8 percent at 844,370 net tons.

Steel exports to Canada fell 3.7 percent to 407,784 net tons (27.3 percent below the previous April) and exports to Mexico fell 8.1 percent to 332,061 net tons (9.8 percent less than last April). European Union steel exports decreased 3.9 percent from March at 29,836 net tons and fell 14.6 percent year over year.

AIIS writes in the April 2015 steel exports release: “Through the first four months of the year, exports are down 11.1 percent at 3.54 million net tons. The decline is almost entirely the result of a 19.4 percent drop in exports to Canada, which total 1.72 million net tons year-to-date. Exports to Mexico, meanwhile, have inched up 2.4 percent this year to 1.38 million net tons, while exports to the European Union have grown 22.2 percent to 141,039 net tons.

“Steel export performance is almost 90 percent dependent on conditions in Canada and Mexico, and neither country has an economy that would be described as robust right now. While Mexico at least had 0.4 percent growth in the first quarter, Canada’s economy shrank by 0.6 percent, the nation’s sharpest decline in gross domestic product since 2009.

“Add to that a U.S. dollar that has grown much stronger against the Mexican peso and the Canadian dollar this year, and the market for steel exports in North America is challenging at best. Canada’s finance minister and many others are predicting improvement north of the border in the second quarter, but the country’s central bank still expects growth of just 1.9 percent this year. The outlook for Mexico is a little better, with growth of 2.2 to 3.2 percent forecast. If the U.S. dollar stays strong – and there do not appear to be many signs that it will not – this may not be enough to have a significant impact on the demand for American steel.” (Source: AIIS)

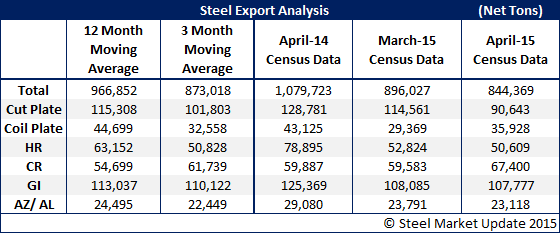

Steel Market Update (SMU) reviewed the data (shown below is net tons) and we found April totals to be below both the 3 month moving average as well as the 12 month moving average.