Market Segment

July 25, 2015

Possible Strike Does Not Worry Buyers & Sellers of Steel

Written by John Packard

By a wide majority, buyers and sellers of flat rolled steel have little to no fear of a possible strike or lockout at either US Steel or ArcelorMittal. At least that is what we found during our most recent flat rolled market analysis conducted last week.

Negotiations have started between ArcelorMittal and US Steel with AM having already submitted their proposal and US Steel scheduled to do so this week. Early comments from the United Steelworkers (USW) suggests that the negotiations are going to be contentious as both AM and USS are asking for changes, especially in the area of health care costs.

Last week Steel Market Update (SMU) conducted one of our flat rolled steel market analysis via the use of an online questionnaire. We invited approximately 540 companies to participate in our market questionnaire. Of the companies responding 45 percent were manufacturers, 40 percent distributors/wholesalers, 9 percent were trading companies, 4 percent toll processors and 2 percent were steel mills.

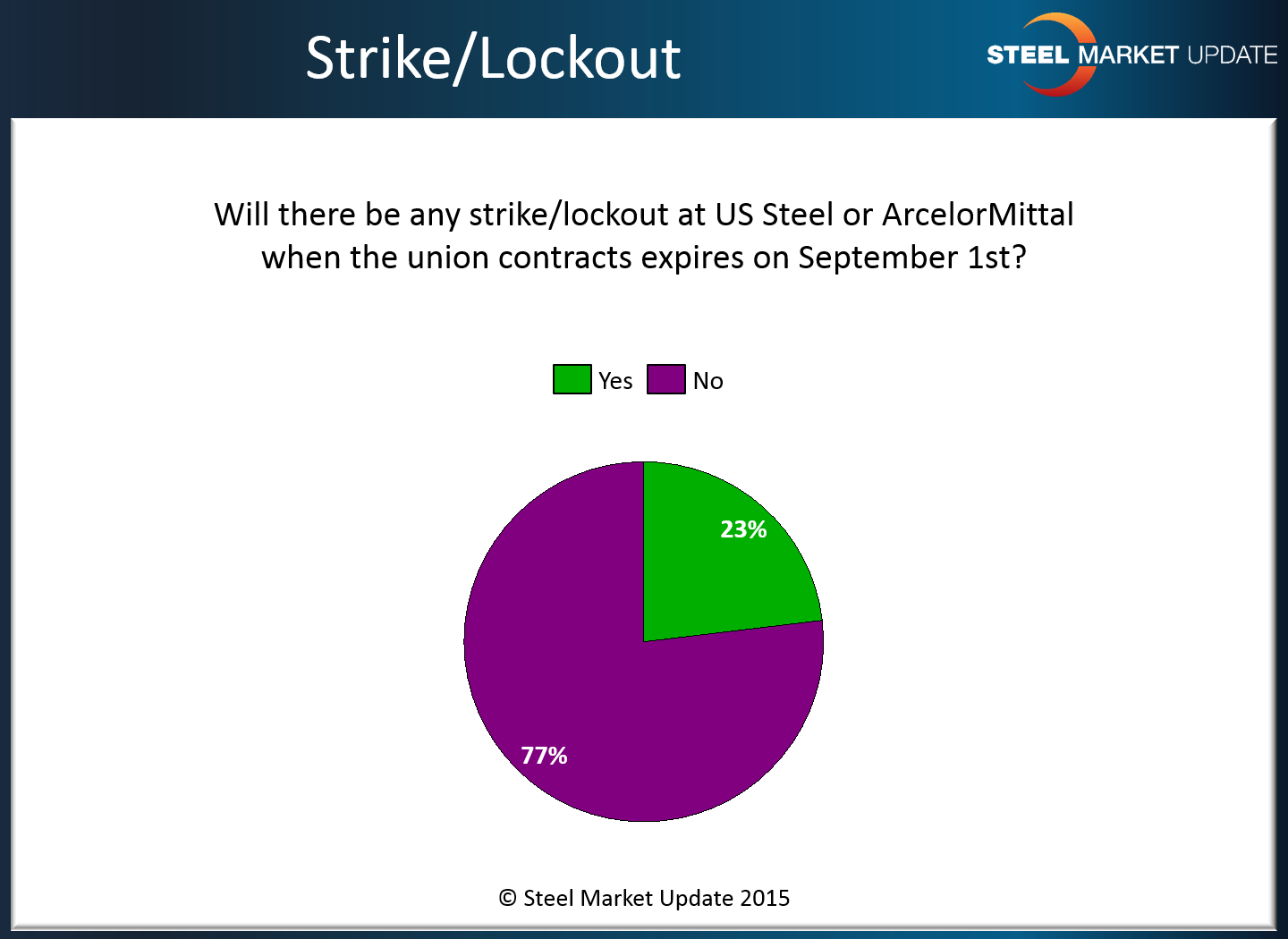

We asked those participating last week, “Will there be any strike/lockout at US Steel or ArcelorMittal when the union contract expires on September 1st?”

Seventy-six percent (77%) replied “No” and the balance (23%) replied “Yes.”

A number of comments were left behind during the process and we thought out readers would be interested in what our participants had to say:

“Both sides have too much to lose, the industry is still in a precarious position, if they want to stem the tide of global imports they need to work together.” Service center

“Why not strike when the most you can get for hrc is $460 ton.” Service center

“If by some chance the union is ridiculous enough to strike, it will be short lived as there is plenty of product out in the market to accommodate one.” Service center

“Only USS and AK can be pummeled by the union, the other guys have no union, the issue to watch is the automotive talks, if they strike, the steel industry will be ravaged.” Manufacturing company (SMU note: AK has settled their contracts last year. ArcelorMittal is the third integrated mill whose contract will expire on September 1st)

“Many say “yes” – I don’t know.” Manufacturing company

“Should be fun, but do not believe this will have much effect in the market, unless it lasts for a month or more.” Service center

“The answer depends on how entrenched the USW chooses to be and how creative the mills are willing to be in reaching a balanced settlement. Still early in the process to see the real issues clearly.” Manufacturing company

“Mills with trade cases would be foolish not to get this settled because it would force people to go back and purchase foreign instead of shutting the faucet down!” Toll processor

“ArcelorMittal USA no. USS, not sure.” Service center

“Wish I could check both.” Service center