Prices

August 4, 2015

SMU Price Ranges & Indices: Stuck (for now)

Written by John Packard

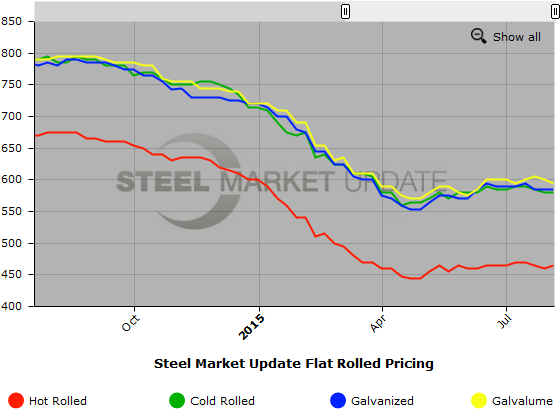

Another week has gone by and flat rolled steel prices have barely budged. This even after the domestic steel mills have filed two trade suits (coated an cold rolled). The expectation is that prices will rise sometime in the future but at the moment there appears to be plenty of inventory and lead times continue to be short on most products. The net result is a stable price market.

Here is how we see spot flat rolled prices this week (all prices shown are in net tons which are equal to 2,000 pounds):

Hot Rolled Coil: SMU Range is $450-$480 per ton ($22.50/cwt- $24.00/cwt) with an average of $465 per ton ($23.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to our revised price last week while the upper end remained the same. Our overall average increased $5 per ton compared to last weeks revised price. SMU price momentum for hot rolled steel is for prices to remain range bound over the next 30 to 60 days.

Hot Rolled Lead Times: 2-5 weeks.

Cold Rolled Coil: SMU Range is $560-$600 per ton ($28.00/cwt- $30.00/cwt) with an average of $580 per ton ($29.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged over one week ago. Our overall average is the same compared to last week. We continue to believe that price momentum on cold rolled steel is for prices to remain range bound over the next 30 to 60 days.

Cold Rolled Lead Times: 4-8 weeks.

Galvanized Coil: SMU Base Price Range is $28.50/cwt-$30.00/cwt ($570-$600 per ton) with an average of $29.25/cwt ($585 per ton) FOB mill, east of the Rockies. Both the lower and upper ends of our range were unchanged over last week. Our overall average is the same compared to one week ago. We continue to believe that price momentum on galvanized steel is for prices to remain within a narrow trading range over the next 30 to 60 days.

Galvanized .060” G90 Benchmark: SMU Range is $639-$669 per net ton with an average of $654 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-7 weeks.

Galvalume Coil: SMU Base Price Range is $29.00/cwt-$30.50/cwt ($580-$610 per ton) with an average of $29.75/cwt ($595 per ton) FOB mill, east of the Rockies. The lower end of our range remained the same compared to one week ago while the upper end decreased $10 per ton. Our overall average is down $5 per ton compared to last week. Our belief is momentum on Galvalume will be prices to remain steady over the next 30 to 60 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $871-$901 per net ton with an average of $886 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks.

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.