Prices

August 6, 2015

June 2015 Steel Exports

Written by Sandy Williams

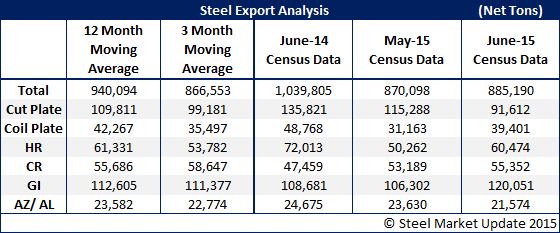

The following report was produced by the American Institute for International Steel (AIIS) regarding U.S. steel exports out of the United States to other countries. At the end of the AIIS press release is a table produced by Steel Market Update with an analysis of both total and flat rolled steel exports.

Falls Church, VA. August 6, 2015. Steel exports increased in June for the second month in a row, growing by 1.7 percent.

The 885,191 net tons of exports were still nearly 15 percent below the June 2014 level, though.

Canada, which accounts for about half of the United States’ steel exports, and Mexico, which accounts for more than a third, both increased their purchases of American steel. Exports to Canada increased by 8.8 percent from May to 444,899 net tons (17.1 percent below June 2014), while exports to Mexico grew by 7.8 percent from May to 338,364 net tons (down 0.9 percent from a year earlier). The monthly gains were partially offset by a 12.9 percent decline in exports to the European Union, which dipped to 23,527 net tons, 17.3 percent below the June 2014 total.

Year to date, exports were down 12.6 percent to 5.3 million net tons compared to the first half of 2014. Canada led the decline, with exports to that country shrinking 20.3 percent to 2.57 million net tons. Exports to Mexico slipped 1 percent to 2.03 million net tons, while exports to the European Union increased 11.2 percent to 191,581 net tons.

As always, the performance of steel exports is largely dependent on the performance of the economies of Canada and Mexico, and neither has been that strong this year. In fact, gross domestic product in Canada shrank in each of the first five months of the year, in large part because of low oil prices, putting the country on the verge of a recession, if it’s not already there. Mexico has also been hurt by the low price of oil, but it, at least, still expects growth of around 2.5 percent this year. These developments are reflected in the United States’ steel export numbers. While exports to Mexico have largely held steady this year, exports to Canada have plummeted. With little indication that oil prices will increase anytime soon and restart dormant drilling and fracking projects, the outlook for steel exports remains bearish.

(AIIS press release)

The table below is provided by SMU: