Market Segment

September 17, 2015

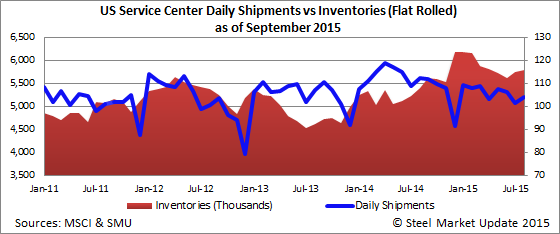

Distributor Flat Rolled Inventories Up as August Shipments Falter

Written by John Packard

The Metal Service Center Institute (MSCI) released August distributor shipment and inventory data on Wednesday of this week. Total steel inventories remained essentially unchanged in August compared to July as the daily shipping rate declined by 3.8 percent. The biggest declines in shipments were attributed to carbon plate (-14.8 percent), structurals (-3.9 percent) and carbon shapes (-3.9 percent). Flat rolled products were actually down the least of all the steel products at -2.2 percent.

Total steel inventories (all products) were reported as being 9,181,900 tons. This represents an increase of 1.9 percent compared to one year ago. Inventories increase to 2.8 months supply well above the 10 year average of 2.4 months and up from the 2.7 months reported in July.

Flat Rolled

Carbon flat rolled shipments totaled 2,181,200 tons, down 2.2 percent compared to July and 7.3 below year ago levels. The daily shipment rate was 103,870 tons per day which was higher than the 101,380 tons per day shipped during the month of July but well below year ago levels at 112,080 tons per day.

Flat rolled inventories ended the month at 5,781,500 tons. Tonnage rose slightly from the prior month when the MSCI reported to be 5,747,700 tons. Tonnage is also 7.3 percent higher than year ago levels.

The number of months of inventory on hand rose from last month’s 2.6 to 2.7. This is the third month in a row where we have seen inventories rising compared to the previous month. This is one of the main reasons why steel prices are failing to move higher and have been drifting lower over the past few weeks.

For those of you interested in knowing how we did with our Apparent Excess/Deficit forecast for the month of August, we forecasted August flat rolled shipments would be 2,236,000 tons so we were slightly higher than the 2,181,200 tons reported by the MSCI (54,800 tons off).

We also forecasted inventories would be 5,748,000 tons at the end of August. We missed inventories by 33,500 tons.

We correctly forecasted that inventories would remain excessively high and we will have more details about that and our new forecasts in our next Premium issue which is due out tomorrow (Friday).

Carbon Plate

Carbon plate shipments totaled 325,300 net tons and shipments were down 14.8 percent compared to the prior month and 14.6 percent less than August 2014. The daily shipment rate was 15,490 tons per day. Last month’s rate was 17,350 tons per day.

Service center inventories stood at 1,050,500 tons down ever so slightly from the 1,065,800 reported at the end of July. The number of months on hand rose from 2.8 months to 3.2 months.

Pipe & Tube

Shipments of pipe and tube products totaled 221,600 tons which represents a decline of 2.9 percent month over month and 6.8 percent year over year. The daily shipping rate of 10,550 tons were essentially in line with the 10,370 tons shipped the prior month but, well below the 11,320 tons per day shipped last year.

Inventories stood at 699,900 tons essentially unchanged from the prior month and up 4.7 percent compared to August 2014.

The number of months on hand increased to 3.2 from 3.1 months at the end of July. Last year the number of months on hand was 2.8.