Prices

December 1, 2015

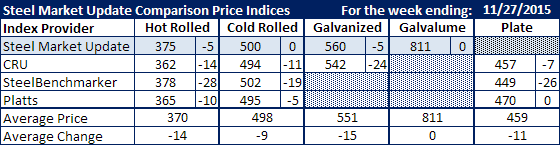

SMU Comparison Price Indices: Small, Medium & Large Price Movement

Written by John Packard

Holiday weeks tend to be “quiet” when it comes to steel price movement but, according to the flat rolled steel indexes followed by Steel Market Update, last week was an anomaly. SMU saw the market as being relatively stable with either no movement or small adjustments of $5 per ton on hot rolled and hot dipped galvanized.

As of this past week SMU hot rolled price average was the second highest of the four steel indexes reporting. As our normal readers are aware our range last week on HRC was $360-$390 per ton which when averaged out gave us our $375 per ton number. We will discuss pricing further in our normal Tuesday evening price discussion as well as in our Final Thoughts at the end of this newsletter.

Even though our numbers did not move as dramatically as others, our SMU Price Momentum Indicator continues to point toward lower pricing as the market searches (prays) for a bottom.

Platts did not publish prices on Thursday or Friday of last week due to the Thanksgiving Holiday so the numbers we have are as of Monday of this week. They, like us, saw the market as having some minor price movement as their hot rolled number dropped a total of $10 per ton (includes $5 on Monday) while cold rolled was down $5 and plate remained the same.

SteelBenchmarker reported numbers last week and their adjustments are based on the movement over a couple of weeks as opposed to one week like the rest of the indexes in our table.

CRU pricing moved relatively dramatically last week with galvanized being reported down $24 per ton in one week, hot rolled down $14 and cold rolled down $11.

We want to advise our readers that the 3+ year relationship we have had with CRU allowing SMU to supply some of their flat rolled price indices (which we pay for) in our Comparison Price Indices report is about to end. They are exercising their right to control access to their numbers and after December 17th we will no longer have the right to publish their numbers in our newsletter or on our website.

FOB Points for each index:

SMU: Domestic Mill, East of the Rockies.

CRU: Midwest Mill, East of the Rockies.

SteelBenchmarker: Domestic Mill, East of the Mississippi.

Platts: Northern Indiana Domestic Mill.