Prices

January 5, 2016

New Flat Rolled Price Increase Expected

Written by John Packard

When SMU was at the recent HARDI conference in December we remember that many of the executives were not interested in taking inventory positions as they felt there still could be more room to fall. From our perspective, looking at prices from a historical perspective, the domestic mills had already suffered lower prices than what we saw during the height of the Great Recession. In our mind, how much lower could we go?

Then we were reminded of what one OEM told us when asked when prices would bottom and move higher. He told us prices would go up when they stopped going down.

Prices have stopped going down and we have seen a rebound in hot rolled from our average low of $360 per ton to $380 per ton ($20 per ton rebound) over the past few weeks. Hot rolled is the weakest product and we are seeing further strengthening on cold rolled and coated products.

We also have to remember the “dead cat bounce” that the market went through in the late spring 2015. Is this market strong enough to keep the gains made (+$20-$30 per ton) and capture more in the coming weeks?

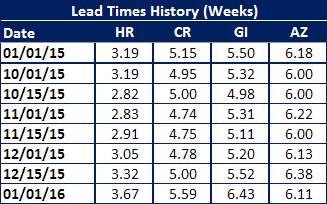

The expectation is for prices to continue to move higher with one of the biggest catalyst being lead times. The data from the table below was pulled from our ongoing flat rolled steel survey which began on Monday morning of this week. The average of all of the responses to date (just shy 100 responses) is showing an improvement in the lead time on all products with the exception of Galvalume (where AZ is affected by normal seasonal issues at this time of the year).

After a dismal 2015 (in comparison to 2014) we are now seeing lead times as being extended further than they were at this time one year ago. This provides support to the mills’ pricing move.

It also leads to the expectation that flat rolled steel prices will be in for another bump or announcement in the coming days. One of the domestic mills told us just prior to the holidays, “Two weeks from now will be the week of truth.”

We are closing in on that week of truth and the expectation is that over the next few days there will be a price increase announcement. A sales representative for one of the domestic mills warned us this afternoon that the increase announcement could come as early as this afternoon but more than likely would be sometime this week.

Taking again from our ongoing flat rolled steel questionnaire, 89 percent of those responding so far are indicating that they expect a new price increase early this year. With those kinds of numbers we expect it will become a self-fulfilling prophesy.