Prices

February 25, 2016

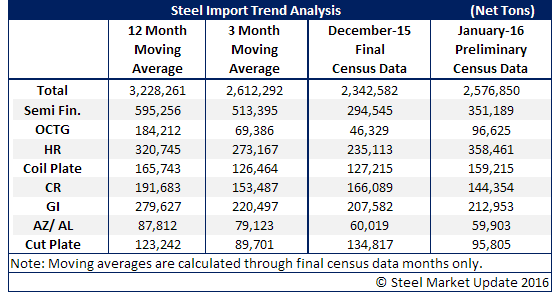

Preliminary Steel Imports Increase 10% in January

Written by Sandy Williams

The American Institute for International Steel reports preliminary steel imports increased significantly to start the year, but they remained far below the level of early 2015. The rest of the press from AIIS follows:

Imports grew by 10 percent from December to January, reaching 2.58 million net tons. This, though, was 41.4 percent less than in January of last year.

Imports from Brazil showed the biggest jump, increasing almost 76 percent to 339,000 net tons, which was still 53.6 percent less than a year earlier. Imports from Mexico, meanwhile, increased 41.2 percent to 236,000 net tons, 17.3 percent less than in January 2015, while imports from Canada grew by 12.5 percent to 488,000 net tons, nearly unchanged from a year earlier. South Korea sent 240,000 net tons of steel to the United States in January, a 2.2 percent month-to-month increase, but a 71.3 percent decline from the previous January. The only significant decrease in January was in imports from the European Union, which were down 28.6 percent to 336,000 net tons, less than half the January 2015 total.

January’s semifinished imports were 56.2 percent lower than a year earlier at 360,000 net tons.

The 10 percent increase in imports was the largest month-to-month growth since a 16.8 percent spike one year earlier that put the monthly total at 4.25 million net tons. It was all downhill from there, though, as imports fell 18.5 percent in February, then continued to decline nearly every other month in 2015. Ideally, the solid import growth to start the year indicates the beginning of a turnaround that will strengthen not just the steel import sector but the economy as a whole. Given the link between steel imports and economic growth, if the import numbers for February and March are similar to January’s, we can probably look for good news when the first quarter gross domestic product numbers are released. If they revert to the 2015 pattern, though, GDP growth might not be so impressive.