Prices

May 10, 2016

March Apparent Steel Supply Down 9.0% YOY, Import Percentage Plummets

Written by Brett Linton

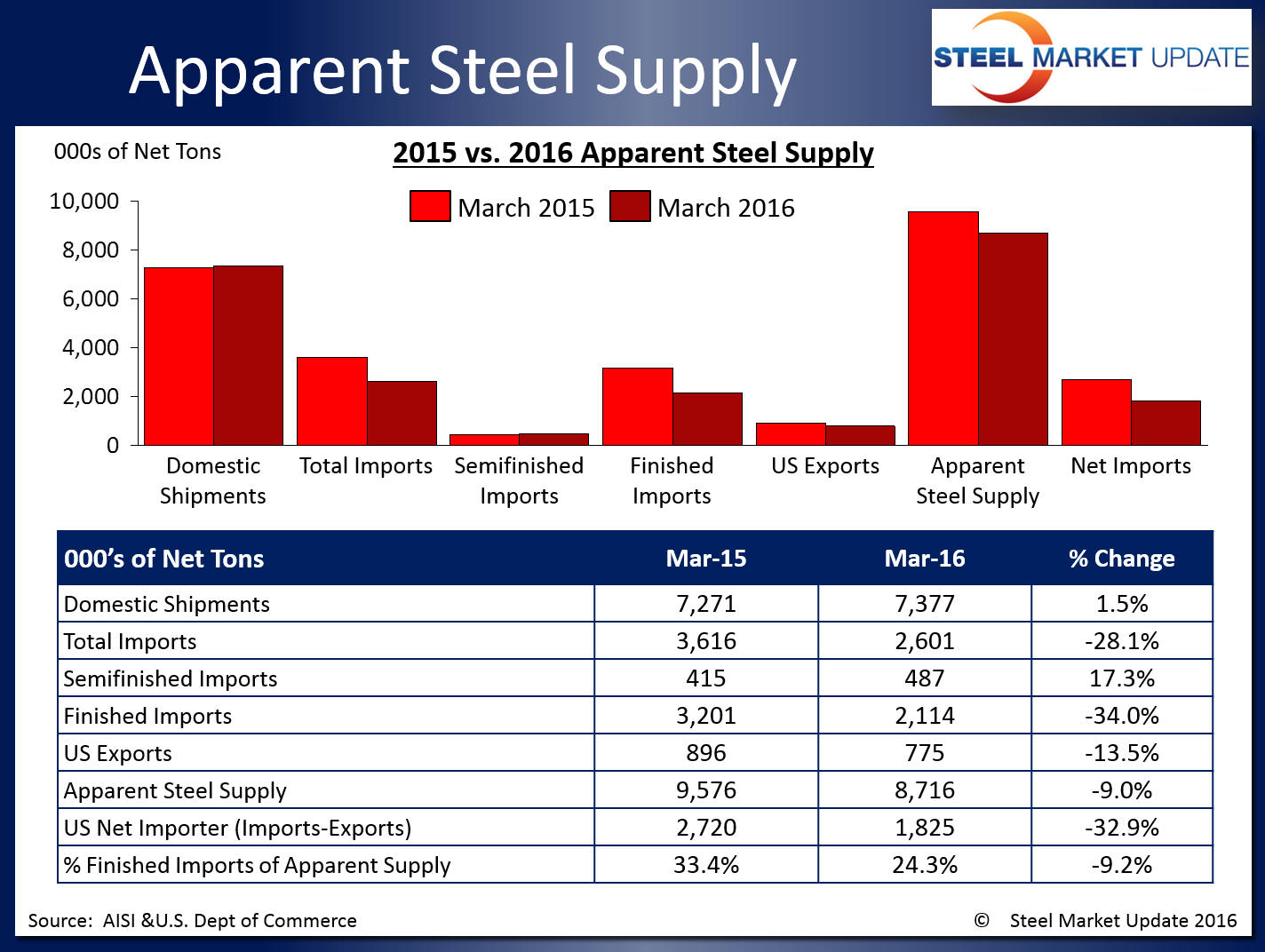

According to the latest data released from the U.S. Department of Commerce and the American Iron and Steel Institute, apparent steel supply for the month of March 2016 was 8,716,178 net tons. Apparent steel supply is calculated by adding domestic steel shipments and finished US steel imports and subtracting total US steel exports.

March apparent steel supply represents a 859,725 ton or 9.0 percent decrease compared to the same month one year ago when apparent steel supply was 9,575,903 tons. This is primarily attributed to a 1,087,080 ton or 34.0 percent decline in finished U.S. steel imports, slightly negated by an increase in domestic shipments of 106,599 tons or 1.5 percent and a decrease in total U.S. steel exports of 120,757 tons or 13.5 percent.

The net trade balance between US steel imports and exports was a surplus of +1,825,488 tons imported in March 2016, 894,445 tons or 32.9 percent less than that of March 2015. Foreign steel imports accounted for 24.3 percent of apparent steel supply, down 9.2 percent over the same month one year ago.

SMU Note: Our Premium Level apparent steel supply analysis goes into more detail as we provide data on apparent steel supply for flat and long products. We plan to publish this analysis later this week.

When compared to last month when apparent steel supply was at 8,269,164 tons, March supply increased by 447,014 tons or 5.4 percent. This increase is attributed to a 437,950 ton or 6.3 percent increase in domestic shipments. Finished imports were nearly flat month over month (up 0.3 percent), as were total exports (down 0.5 percent).

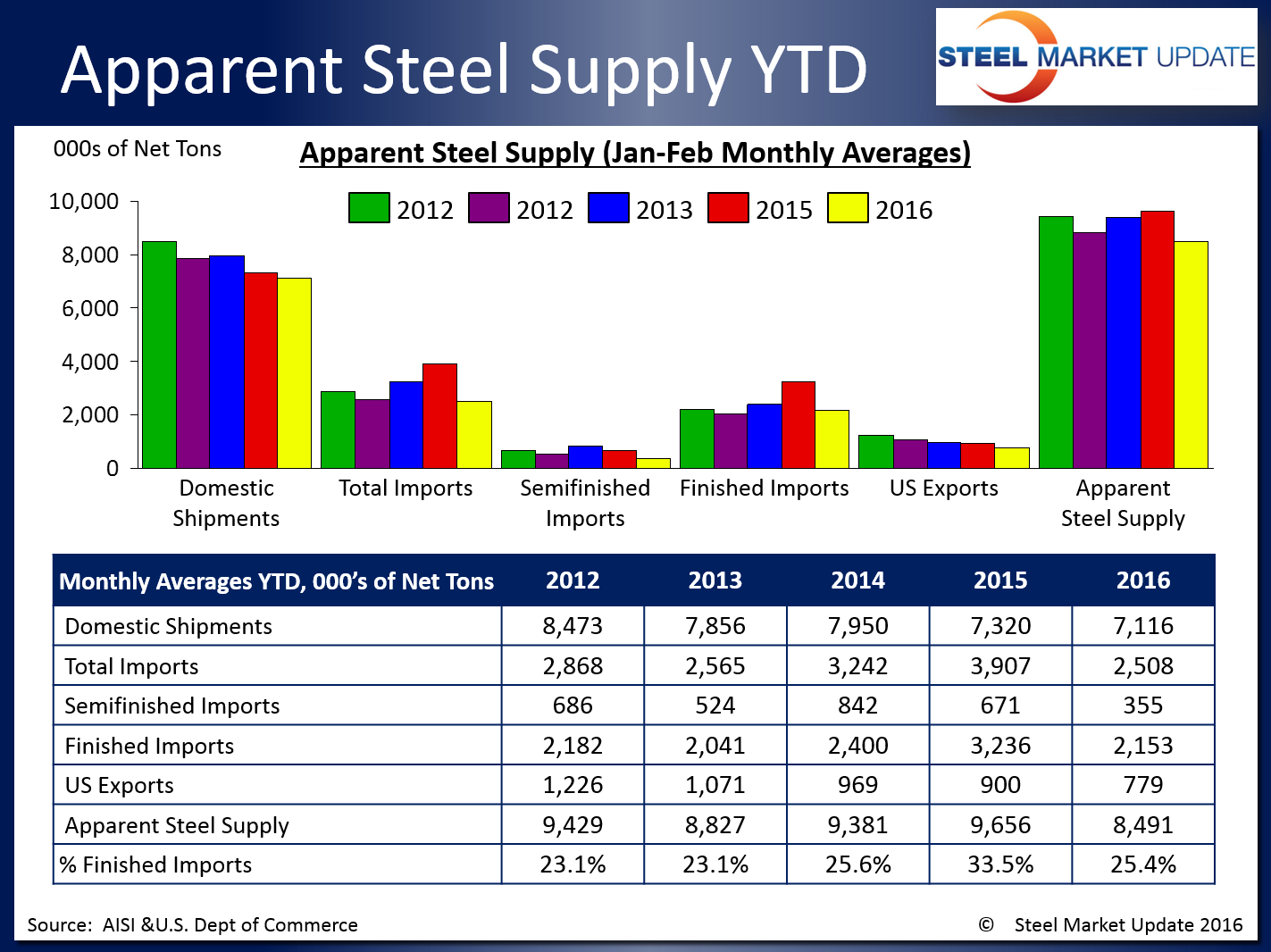

The table below shows year to date totals for each statistic over the last five years. Note that these averages are calculated through the first three months of the year. 2016 figures so far are lower than most of the previous years for all items listed.

To see an interactive graphic of our Apparent Steel Supply History, visit the Apparent Steel Supply page in the Analysis section of the SMU website. If you need any assistance logging in or navigating the website, contact us at info@SteelMarketUpdate.com or 800-432-3475.