Prices

May 31, 2016

SMU Price Ranges & Indices: No Momentum Change Seen Yet

Written by John Packard

With the extended weekend in the United States there was very little movement in flat rolled steel prices compared to late last week. Our benchmark hot rolled average remained the same although we did pick up some movement, especially with a tightening of the lower end of the range, on the other flat rolled products.

We spoke with one smaller mill today who told us they were content with base prices in the $41.50/cwt-$42.50/cwt range on coated steel products and did not feel a need to push prices higher. Other mills may be feeling similar sentiments as the price spread between hot rolled and cold rolled/coated is quite dramatic at $200 per ton (+/- $10 per ton). We will need to go back in our history books to see if there was ever a price spread this large.

The steel buyers with whom SMU spoke today reported that mill order books remain strong. One service center did report a tinge more spot availability out of the integrated mills but not enough to raise a red flag quite yet.

A service center executive told us that the domestic steel mills should be quite healthy at the current price levels. He said, “If you can’t make money at $41-$42 you should bankrupt the company and find something else to do.”

We will see what the mills decide to do from here. SMU does not expect anything to happen until scrap negotiations are concluded late this week or early next week.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $610-$650 per ton ($30.50/cwt- $32.50/cwt) with an average of $630 per ton ($31.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained the same compared to one week ago. Our overall average is unchanged over last week. SMU price momentum for hot rolled steel has prices rising over the next 30 days.

Hot Rolled Lead Times: All mills on controlled order entry or allocation

Cold Rolled Coil: SMU Range is $820-$850 per ton ($41.00/cwt- $42.50/cwt) with an average of $835 per ton ($41.75/cwt) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to last week while the upper end increased $10 per ton. Our overall average increased $15 per ton over one week ago. SMU price momentum for cold rolled steel is for prices to increase over the next 30 days.

Cold Rolled Lead Times: All mills on controlled order entry or allocation

Galvanized Coil: SMU Base Price Range is $41.50/cwt-$42.50/cwt ($830-$850 per ton) with an average of $42.00/cwt ($840 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to one week ago while the upper end remained the same. Our overall average is up $10 per ton over last week. Our price momentum on galvanized steel is for prices to move higher over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $890-$910 per net ton with an average of $900 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: All mills on controlled order entry or allocation

Galvalume Coil: SMU Base Price Range is $41.50/cwt-$42.50/cwt ($830-$850 per ton) with an average of $42.00/cwt ($840 per ton) FOB mill, east of the Rockies. The lower end of our range rose $10 per ton compared to last week while the upper end remained unchanged. Our overall average increased $5 per ton over one week ago. Our price momentum for Galvalume steel is currently pointing towards an increase in prices over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1121-$1141 per net ton with an average of $1131 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: All mills on controlled order entry or allocation

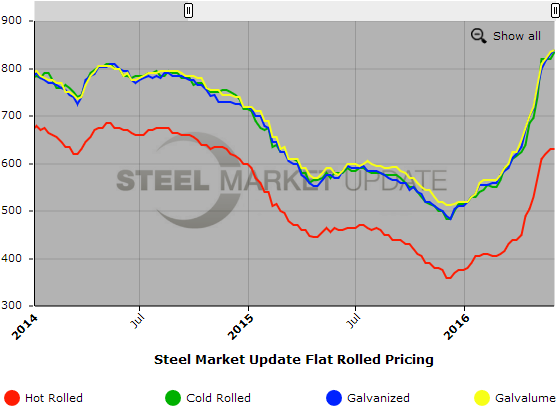

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.