Prices

June 21, 2016

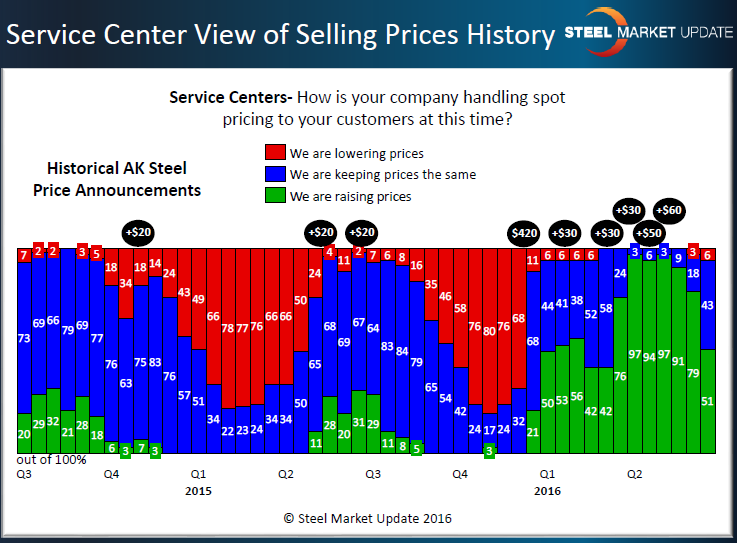

Service Centers Support for Higher Spot Prices Shifting?

Written by John Packard

Manufacturing companies reported steel service center spot prices as continuing to rise this past week. Seventy-eight percent of the manufacturing companies responding to our mid-June flat rolled steel market trends questionnaire said distributors were continuing to raise spot prices on flat rolled steel.

The service centers themselves were less optimistic with only 51 percent of the distributors reporting their company as raising flat rolled steel spot prices to their end customers. Forty-three percent reported spot prices as remaining the same and 6 percent said their company was beginning to lower spot prices.

The change in the service center answering pattern has been quite dramatic. Two weeks ago 79 percent reported their company as raising spot prices and over the last few months as many as 97 percent of the distributors responding to our survey were reporting spot prices as rising.

With the domestic mills having just announced new price increases (at least at Mittal and NLMK) the slippage in spot support is significant. We will have to watch this indicator over the next few weeks to see if the service centers are willing to support even higher spot prices or if they feel it is time to cap the amount of the increases being collected in the spot markets.

It is SMU opinion that it is necessary to have the steel distributors supporting higher spot prices if the mills want to collect higher prices. Looking back in recent history in the graphic below, the first $20 per ton increase announced by AK Steel in late 2014 failed. The first increase in late 2nd Quarter 2015 succeeded but only for a very limited time period (dead cat bounce). Most of the increases announced since late 4th Quarter 2015 have been collected. AK Steel has not yet followed the increases announced today (and may not as their spot tonnage is limited and their pricing may already exceed the numbers being suggested by AMUSA or NLMK USA).