Analysis

July 20, 2016

ABI Slips in June But Growth Trend Continues

Written by Sandy Williams

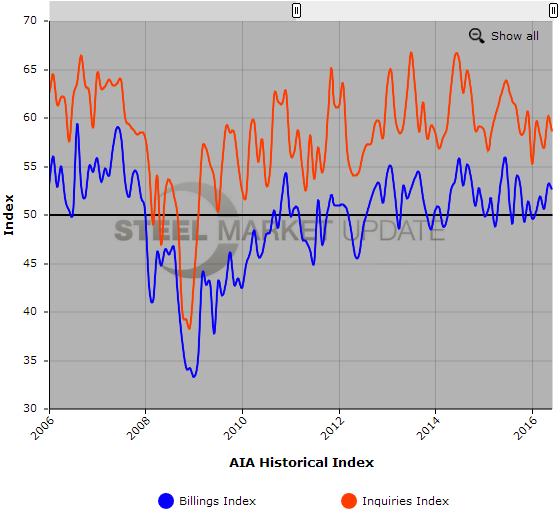

The Architecture Billings Index remained positive in June but slipped to 52.6 to 53.1, according to the latest survey by the American institute of Architects. The new projects inquiry index dropped to 58.6 from 60.1 the previous month. Any reading above 50 indicates a growth in design services.

“Demand for residential projects has surged this year, greatly exceeding the pace set in 2015. This suggests strong future growth for housing in the coming year,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “While we expect to see momentum continue for the overall design and construction industry in the months ahead, the fact that the value of design contracts dipped into negative territory in June for the first time in more than two years is something of a concern.”

Key June ABI highlights:

- Regional averages: South (55.5), West (54.1), Northeast (51.8), Midwest (48.2)

- Sector index breakdown: multi-family residential (57.9), institutional (52.7), mixed practice (51.0), commercial / industrial (50.3)

- Project inquiries index: 58.6

- Design contracts index: 49.7

About the AIA Architecture Billings Index

The Architecture Billings Index (ABI) is considered a leading economic indicator of construction activity, and reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The regional and sector categories are calculated as a 3-month moving average, whereas the national index, design contracts and inquiries are monthly numbers. The monthly ABI index scores are centered around the neutral mark of 50, with scores above 50 indicating growth in billings and scores below 50 indicating a decline.

Below is a graph showing the history of the Architecture Billings Index and Inquiries Index. You will need to view the graph on our website to use it’s interactive features, you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.