Analysis

September 11, 2016

Korean Antidumping Duties Impact Kia and Hyundai

Written by Sandy Williams

The duties on automotive steel from Korea due to antidumping (AD) may affect pricing of vehicles at Hyundai and Kia here in the U.S.

Dumping and countervailing duties have been determined by the Department of Commerce on imports of Korean coated, hot-rolled, and cold-rolled steel. Hyundai Steel, part of Hyundai Group, exports approximately 545,000 tons of steel to the U.S. annually, 40 percent of which is automotive steel designated for Hyundai and Kia manufacturers.

James Bell, Director of Corporate Communications for Kia Motors America, was in Seoul this week and provided the following statement to Steel Market Update.

“As the recent developments regarding dumping duties imposed by the U.S. Department of Commerce on automotive steel imports from Korea will have some impact on our material purchasing activities, we are carefully studying the possible implications on the Kia business and will take appropriate action if necessary.”

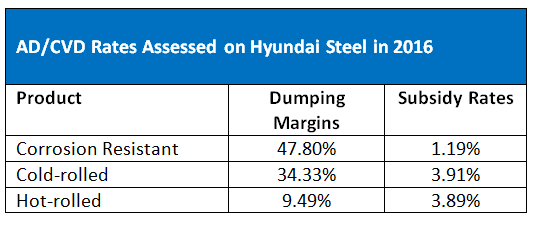

Although Bell stopped short of announcing any price increases, analysts think that it is possible that increased import costs on steel from Korea could result in higher automotive costs for consumers. According to the Korea Herald, about 80 percent of the steel used in vehicles is coated steel. Hyundai Steel, which provides half the coated steel used by Hyundai and Kia, receive AD/CVD duties totaling 50 percent from the Department of Commerce.