Prices

September 13, 2016

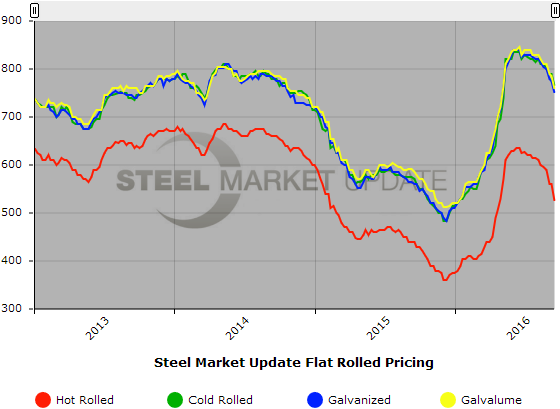

SMU Price Ranges & Indices: OUCH!

Written by John Packard

Whoops, who left the door open? It seems like all the hot air has been sucked out of this steel market, at least for the time being.

Flat rolled steel prices have been moving dramatically lower over the past few weeks. Steel buyers are telling SMU that the domestic steel mills are anxious to negotiate, especially on hot rolled. However, we are seeing significant price movement in all of the flat rolled products. Steel buyers are telling SMU that the drop in scrap prices is affecting negotiations, especially with the EAF (electric arc furnace) mills. Prices are trending a little lower in the south than in the Midwest but steel prices are dropping in both markets. We warn steel buyers to do their homework, ask questions about extras, freight, tonnage discounts, etc.

Here is how we see prices this week:

Hot Rolled Coil: SMU Range is $500-$550 per ton ($25.00/cwt- $27.50/cwt) with an average of $525 per ton ($26.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to one week ago while the upper end decreased $40 per ton. Our overall average is down $35 over last week. Our price momentum on hot rolled steel is for prices to trend lower over the next 30 days. SMU Note: buyers should be aware that HRC extras/freight may be negotiable depending on product, location and competitive situation. When taking extras and freight into consideration our average may be over-stated by $10 to $20 per ton.

Hot Rolled Lead Times: 2-5 weeks

Cold Rolled Coil: SMU Range is $740-$790 per ton ($37.00/cwt- $39.50/cwt) with an average of $765 per ton ($38.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 per ton compared to last week while the upper end decreased $20 per ton. Our overall average is down $25 over one week ago. Our price momentum on cold rolled steel is for prices to trend lower over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU Base Price Range is $36.50/cwt-$38.50/cwt ($730-$770 per ton) with an average of $37.50/cwt ($750 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to one week ago while the upper end decreased $30 per ton. Our overall average is down $25 over last week. Our price momentum on galvanized steel is for prices to trend lower over the next 30 days.

Galvanized .060” G90 Benchmark: SMU Range is $790-$830 per net ton with an average of $810 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 2-8 weeks

Galvalume Coil: SMU Base Price Range is $36.75/cwt-$39.00/cwt ($735-$780 per ton) with an average of $37.875/cwt ($757.50 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $25 per ton compared to last week while the upper end decreased $30 per ton. Our overall average is down $27.50 over one week ago. Our price momentum on Galvalume steel is for prices to trend lower over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU Range is $1026-$1071 per net ton with an average of $1048.50 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, and Galvalume price history. To use the graphs interactive capabilities, you must view it on our website here. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or by calling 800-432-3475.