Analysis

December 7, 2016

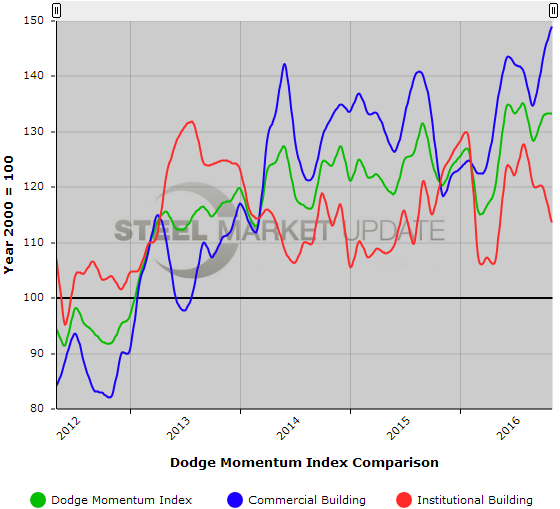

Dodge Momentum Index up 18 percent Y/Y

Written by Sandy Williams

The Dodge Momentum Index gained 0.3 percent in November after breaking a five month streak of increases in October. The Dodge Momentum Index, published by Dodge Data & Analytics, is a monthly measure of the first (or initial) report for nonresidential building projects in planning which have been shown to lead construction spending for nonresidential buildings by a full year. The index has increased 10 out of the last 12 months and is 18 percent higher than its reading in November 2015.

Commercial activity led the gain last month, with a 4.1 percent increase from October. Commercial planning has gained 35 percent year over year after a weak start in 2016. Institutional planning was down 5.2 percent in November and is 2 percent lower year over year.

“While trending higher over the last year, volatility has been the hallmark of the Momentum Index in 2016, matching the uneven pace of growth in the overall economy. It is likely that the volatility will persist in the months ahead,” said Dodge Analytics.

Seven projects exceeding $100 million each entered the planning stage in November.

Below is a graph showing the history of the Dodge Momentum Index. You will need to view the graph on our website to use its interactive features, you can do so by clicking here. If you need assistance logging into or navigating the website, please contact our office at 800-432-3475 or info@SteelMarketUpdate.com.