Prices

February 16, 2017

Hot Rolled Futures: Buy The Dips

Written by David Feldstein

The following article on the hot rolled coil (HRC) futures markets was written by David Feldstein. As the Flack Global Metals director of risk management, Dave is an active participant in the hot rolled coil (HRC) futures market and we believe he will provide insightful commentary and trading ideas to our readers. Besides writing Futures articles for Steel Market Update, Dave produces articles that our readers may find interesting under the heading “The Feldstein” on the Flack Global Markets website www.FlackGlobalMetals.com.

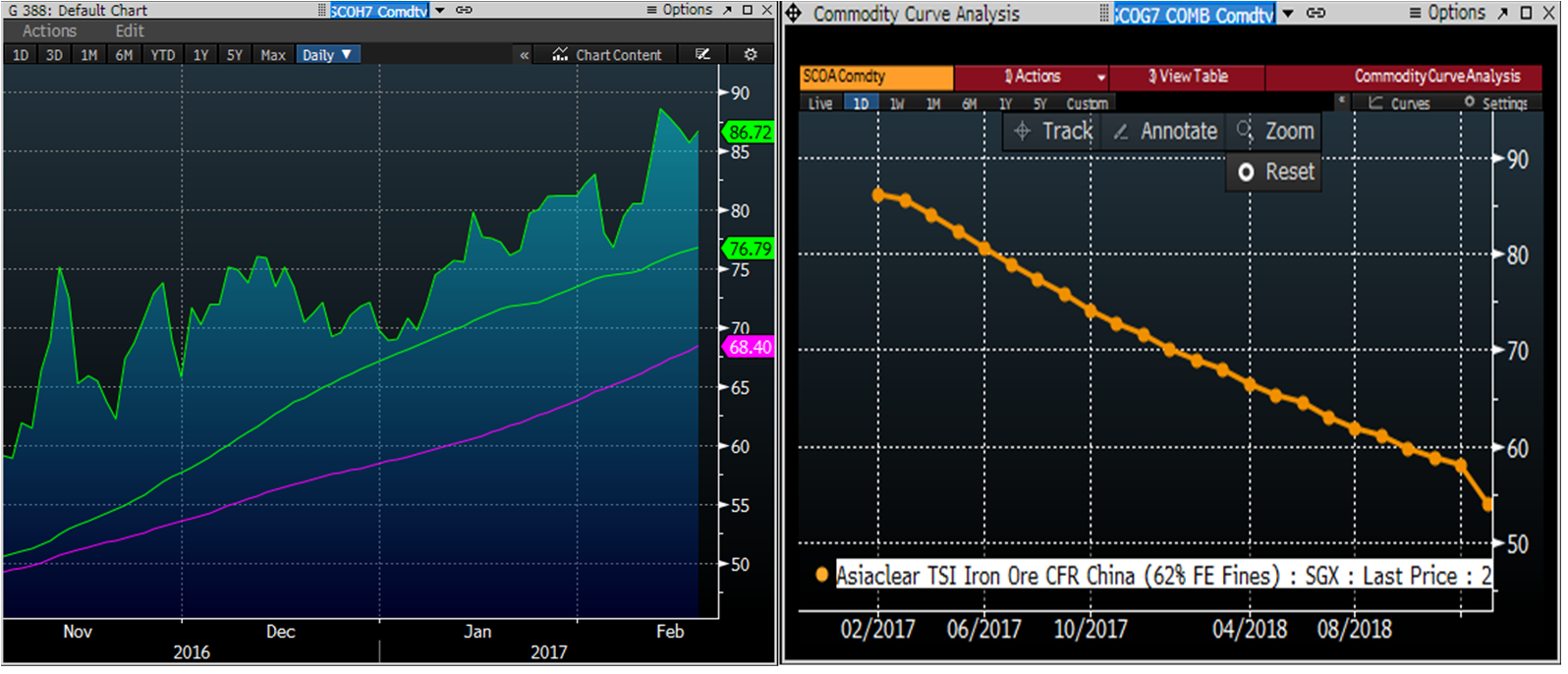

Iron ore leapt from $80/t to $90/t in two days last week before closing today at $86.72. The chart on the left is the March SGX iron ore future. The chart on the right is the backwardated (downward sloping) SGX iron ore futures curve.

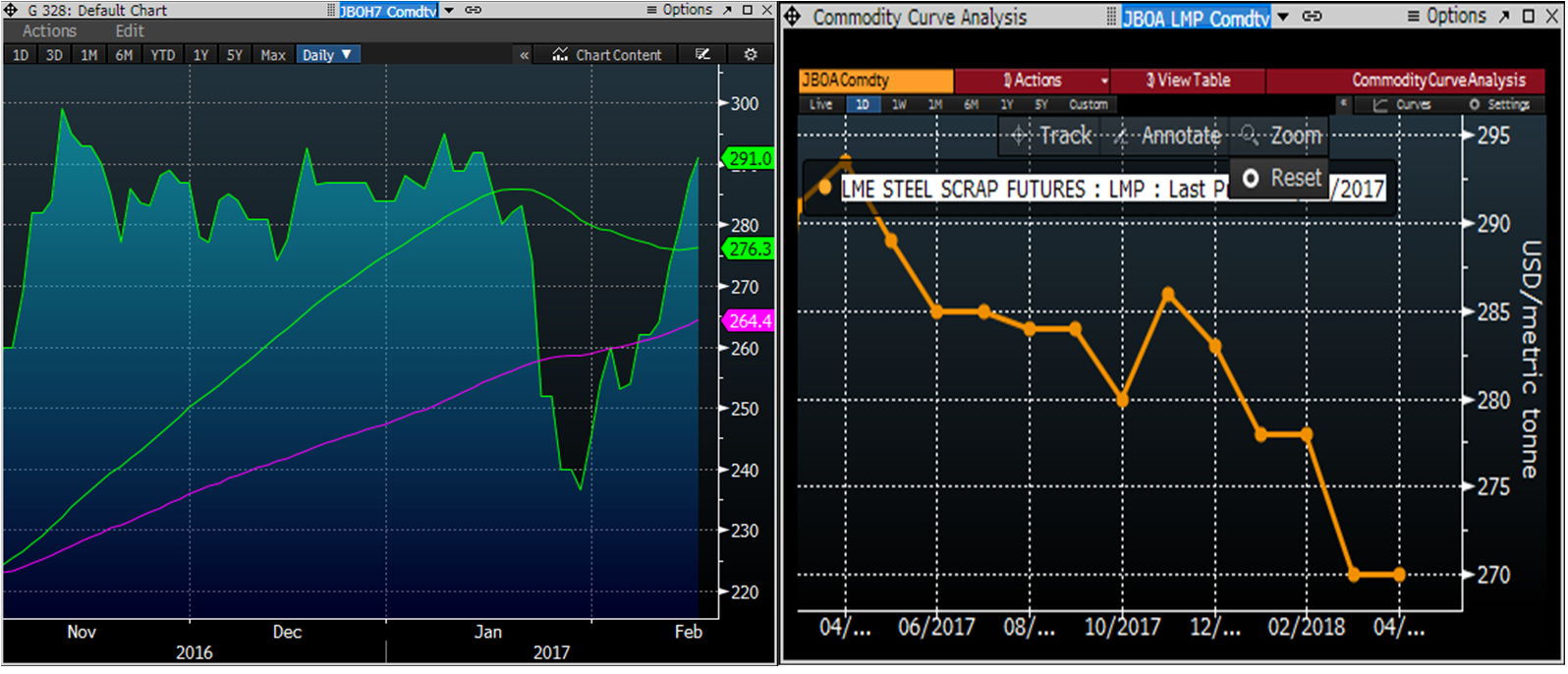

The March LME Turkish scrap futures (below left) closed yesterday at $291/t. The V-shaped recovery in scrap has been nothing short of amazing. In 30 days, scrap fell 19 percent before rallying back to even. What looks to have been a panicked sale of scrap at the end of January quickly reversed as HRC sentiment improved, then Nucor announced that their Louisiana DRI plant would be shut down for five weeks and then Chinese iron ore prices rallied sharply. The LME scrap futures curve is on the right and is also backwardated.

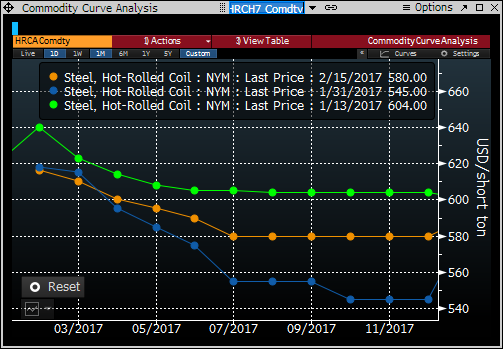

The rebound in scrap prices erased the most obvious bearish factor weighing on domestic flat rolled prices. Strength in iron ore, solid domestic demand data and inventory levels at a multi-year low have boosted domestic flat rolled sentiment. March HRC futures closed at $610/st last night (below left).

The CME Midwest HRC futures curve is backwardated (right above), similar to the curves for the SGX iron ore and LME Turkish scrap futures. Unlike the stock market which sees prices crash down, commodity prices tend to “crash up” due to shortages of the commodity (except last month in scrap). A number of academic research papers conclude that the risk of a commodity’s price “crashing up” correlates well with falling inventory levels. That is relatively low and falling inventory levels increase the risk of a shortage. For many months, the Week-Over-Week Report published at www.flackglobalmetals.com has highlighted the low inventory levels not only in the MSCI flat rolled inventory data, but also across the manufacturing industry as evidenced in the ISM Manufacturing Report and the Durable Goods Report (for a deep dive into the most recent ISM Manufacturing PMI see Week-Over-Week 2/3/2017).

The majority of the time, the shape of a commodity’s futures curve is mostly driven by supply side fundamentals. For instance, the SGX iron ore futures curve has been in backwardation for years due to iron ore’s massive global oversupply. During that time, the Midwest HRC futures curve has shifted between being flat, in contango and backwardated. So is the current backwardation in the Midwest HRC futures curve appropriate?

I would argue it is not. I would say the market is failing to price in the upside risk inherent in what looks to be an undersupplied market comprised of low inventory levels and a lack of actual and potential supply from the import channel. However, much of the outcome will have to do with the demand side of the equation, which appears to be strong and robust.

When Turkish scrap prices collapsed at the end of January, second half 2017 HRC futures also dropped from $600/st on January 13th to $550/st on January 31st (see above). Since then, 2H 17 has rebounded nicely to $580/st and bears watching. If the HRC curve flattens and then moves into contango, it could be the first indication that market participants are becoming concerned that domestic availability is tightening.