Analysis

April 24, 2017

Final Thoughts

Written by John Packard

Steel Market Update has been working on trying to get a better understanding of the pipe and tube business. We had a conversation with Barry Zekelman, Chairman and CEO of Zekelman Industries, the largest privately held pipe and tube manufacturer in the country.

Our initial conversation was about foreign steel imports and how they were dominating the standard pipe industry, even after Zekelman was successful in an antidumping suit against the Chinese.

The vast majority of the standard pipe industry is ERW (electric resistance weld) and the barriers to entry into the market are quite low. According to Mr. Zekelman, “All you need is a small mill.”

He spoke to me about how the Chinese (and others) can get around (or circumvent) the duties imposed on standard pipe by changing the HTS code and shipping it as line pipe or mechanical pipe. I was told how pipe is “dual stenciled” with APL and ASTM Grades. You can see it for yourself. Just walk into Home Depot and check out the steel pipe in the plumbing section. The Home Depot I went to here in Florida had pipe from India and South Africa. Sorry, no American made pipe.

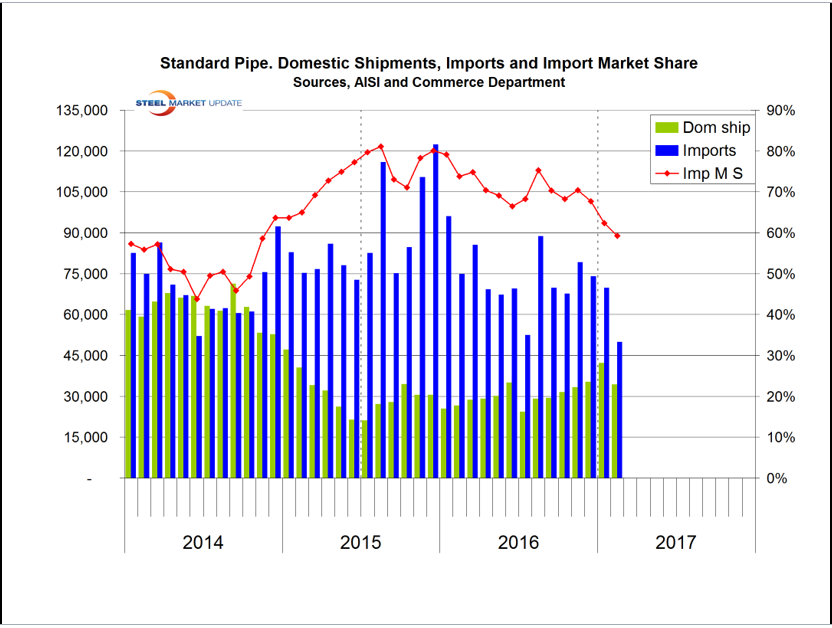

Being involved in the flat rolled business I don’t always get to see some of the other products where imports have basically pushed American companies out of existence. Take standard pipe for example, here is what the domestic and foreign market share looks like for standard pipe:

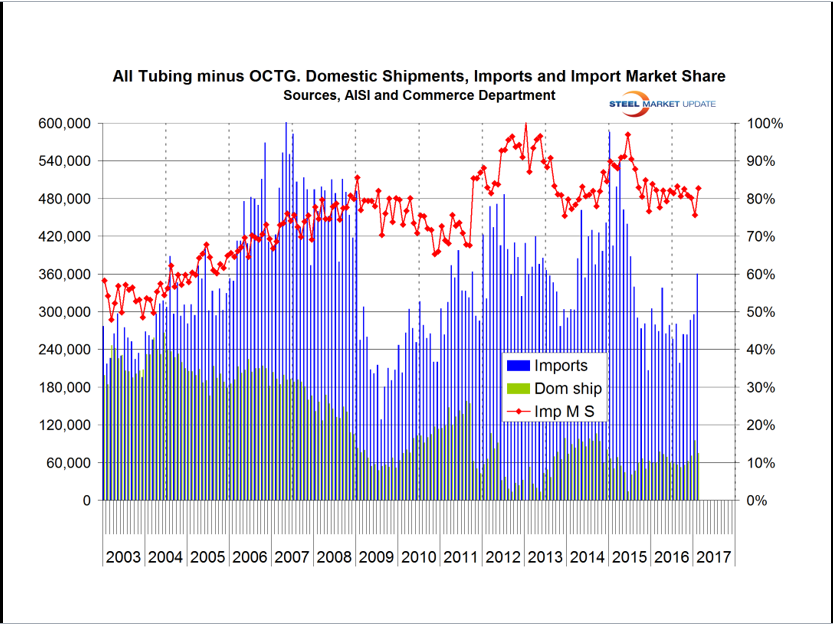

Here is what it looks like if you combine all of the pipe classifications except oil country tubular goods (OCTG):

Not a pretty sight. The blue lines are foreign shipments vs. the domestic (green lines) shipments. The red line indicates the foreign market share of the pipe market (all but OCTG). What is not known is if the AISI has the market size listed incorrectly. We will be working on that question in the future.

When I asked Peter Wright to run these graphics for me one of the graphs was on line pipe. The problem with that graph was foreign shipments exceeded the total market size (do you think there is some standard pipe in the line pipe numbers?).

So, do I think the President is going to try to use the trade laws to go after those products that have been pushing American companies out of existence? Well, the President and Secretary Ross just took a shot across the bow to Canada on wood.

I have been asked to comment on the status of the Vietnam/China circumvention complaint. I will be speaking with trade attorney Lewis Leibowitz either on Wednesday or Thursday and hope to have something on the subject (as well as more on Section 232 and possibly 201) for Thursday’s issue of SMU.

Stay tuned and join us at our 7th SMU Steel Summit Conference on August 28, 29 & 30th. We will have plenty of qualified speakers, including Barry Zekelman and Lewis Leibowitz, to speak about free and fair trade and what it means to manufacturing and the steel industry. Go to www.SteelMarketUpdate.com/events/steel-summit for more details.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, Publisher