Prices

June 15, 2017

Foreign Steel License Data Shows Imports Trending Up

Written by John Packard

The U.S. Department of Commerce reported foreign steel import data earlier this week. Based on license data through June 13, foreign steel imports are on track to once again top 3 million net tons. This would be the fourth consecutive month of imports reaching the 3 million ton mark.

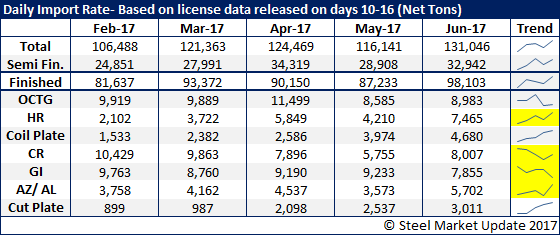

Steel Market Update (SMU) looks at the license data in two ways. We project an end-of-month total based on the daily license rate (now through 13 days only), and we look at how the license totals to date compare against previous months (see table below).

Right now steel imports are trending higher on a number of products even though we are coming off of three months of 3.4 million tons or greater. This has to be concerning to the domestic steel mills and the U.S. Department of Commerce, which is just about to make a recommendation on the Section 232 investigation (national security – see other article in tonight’s issue).

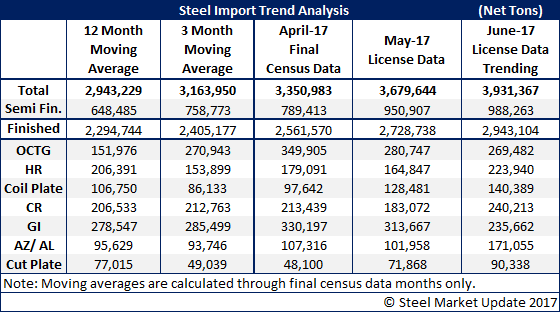

The next table depicts what the license data is suggesting for total imports based on 13 days worth of data. In SMU’s opinion, the 3.9 million net ton level is an over-reach. At this point, we are more comfortable stating that the month will be above 3.0 million tons and continue the high import rate we’ve seen over the past four months.

SMU has updated our table on imported steel. You will notice that we have added a line item for “Finished” steels. To make the table more useful we have done the math for you, subtracting semi-finished steels (slabs and billets that are going to the steel mills) and totaling the finished steels that are dedicated to the end users and service centers.

You can review the anticipated, albeit aggressive, totals based on the first 13 days of license data to give you some idea of the trend. We will update imports again after Tuesday at 5 p.m. when license data will be provided by the Department of Commerce.