Government/Policy

June 15, 2017

Section 232 TRQ Possibilities

Written by John Packard

One of the suggestions being floated within the steel industry is that Wilbur Ross will recommend some form of TRQ (trade rate quota) system whereby quotas are set up based on an average period of time. To help our readers imagine what that might mean we have taken two periods of time on galvanized steel imports and provided what the average would look like.

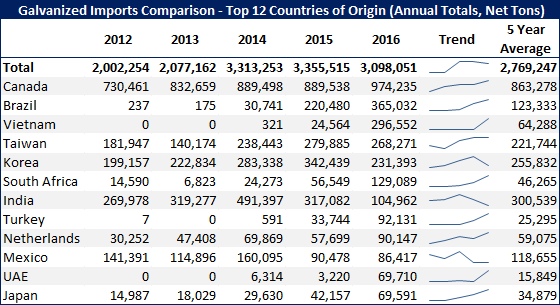

The first table is based on imports for five years starting with the last year we have a full year’s worth of data (2016) and then looking at the previous four years to come up with a 5-year monthly average. As you can see from our first table the 5-year monthly average for 2012-2016 is 2,769,247 tons per month.

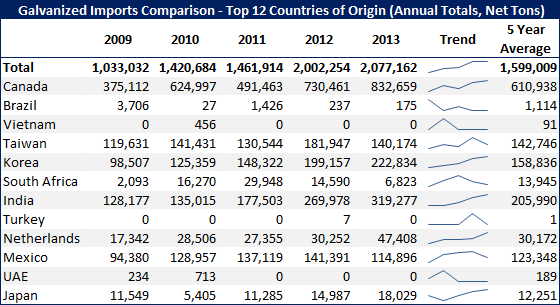

We have also heard that there was a suggestion that the time period should be prior to the import “surge” which we have translated to mean 2014 – the year prior to the antidumping and countervailing duty suits being filed during 2015. Based on that premise we would be looking at the years 2009-2013. The 5-year monthly average drops to 1,599,009 net tons (not metric tons). The difference is due to the Great Recession and the limited number of tons that were being sold during that time period.

We will have to wait and see what happens and we welcome any ideas that you might have on the subject.