Canada

August 15, 2017

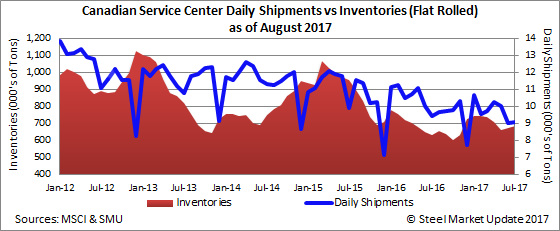

Canadian Service Center Shipments Decline, Inventories Rise

Written by Brett Linton

Steel shipments by Canadian service centers in July totaled 346,500 net tons, down 11.7 percent from the previous month, but up 8.7 percent from July 2016, reports the Metals Service Center Institute (MSCI). On a daily basis, total shipments were 17,300 tons per day in July (a 20-day month), down from 17,800 tons per day in June (a 22-day month), but up compared to a year ago when they were 15,900 tons per day (a 20-day month). Total steel inventories at the end of the month were 1,173,800 tons, up 3.1 percent from last month and up 6.6 percent from this time last year.

The daily average receipt rate for July was 19,085 tons per day, down from 19,159 in June. Total July steel receipts were 381,700 tons, down 39,800 tons over June. According to the MSCI, total steel product inventories stood at 3.4 months at the end of July, up from 2.9 months the month before.

Flat Rolled

Canadian shipments of flat rolled products in July totaled 181,000 tons, down 8.5 percent from June and down 4.0 percent over the same month one year ago. Daily shipments remained at 9,000 tons per day from June to July, but were down compared to one year ago when they were 9,400 tons per day. Inventories at the end of the month were 686,900 tons, up 2.1 percent from last month and up 8.5 percent from the same month one year ago. The daily receipt rate for July was 9,760 tons per day, up from 9,445 tons per day in June. Total tonnage received was 195,200 tons, down from 207,800 tons the month before. Flat rolled inventories stood at 3.8 months in July, up from 3.4 months of supply in June.

Plate

Canadian shipments of plate products in July were 68,100 tons, a decrease of 13.1 percent from the previous month, but an increase of 40.5 percent from July 2016. Daily shipments decreased from 3,600 tons per day last month to 3,400 tons per day in July. Inventories at the end of the month were 177,200 tons, up 6.0 percent from last month, but down 13.8 percent from the same month one year ago. The daily average receipt rate for July was 3,910 tons per day, up from 3,709 tons per day the month before. Plate inventories ended the month at 2.6 months, up from 2.1 months the month before.

Pipe and Tube

Canadian shipments of pipe and tube products in July were 45,300 tons, a decrease of 17.6 percent from the month before, but an increase of 20.1 percent from the same month last year. Daily shipments declined from 2,500 tons in June to 2,300 tons per day in July. Inventories at the end of the month were 124,400 tons, up 2.1 percent from last month and up 3.7 percent from the same month one year ago. The daily average receipt rate for July was 2,395 tons per day, down from 2,723 tons per day the month before. Total months on hand for pipe and tube inventories stood at 2.7 months, up from 2.2 months in June.