Prices

September 21, 2017

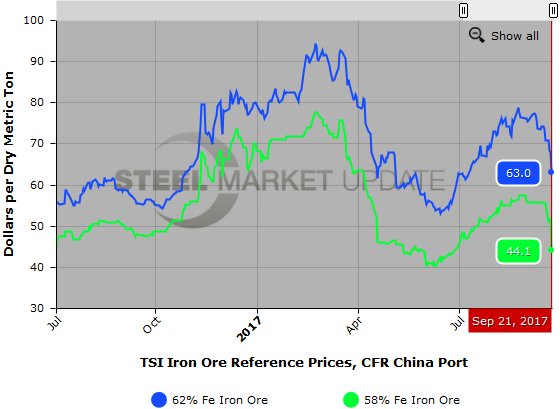

Iron Ore Prices Under Pressure in China (Will Steel Soon Follow?)

Written by John Packard

Spot iron ore pricing dropped 7.4 percent within the past 24 hours with 62% Fe iron ore fines hitting $63 per dry metric ton (dmt). Iron ore has dropped $15.80/dmt over the past month. On Aug. 22, 62% Fe fines were trading at $78.8/dmt, according to The Steel Index.

This morning, we received a note from one of our trading friends in China. He told us to expect iron ore to “continue a downward spiral unless something dramatic occurs. China ports still holding 140 million metric tons of ore.”

We also spoke with Kurt Fowler of The Steel Index (one of our speakers at the 2017 SMU Steel Summit Conference) and he advised that the drop in iron ore pricing in China began in earnest on Friday of last week. He told us, “…it appears that the futures trading on various platforms has led the declines in the physical market prices.”

Fowler went on to discuss port stocks. “We track the major Chinese ports and they are above 130 million tonnes collectively. This build began a year ago, but dramatically increased in the January 2017 timeframe.”

Chinese Steel Price Bubble About to Burst?

Our Chinese trading source advised SMU that, in his opinion, the Chinese steel price “bubble is about to burst.”

He told us, “Remember the song by Glenn Frey, The Heat is On? Price corrections are on a roll now. We had an offer of 1.8mm HRC for cold reduction at USD630/mt fob st lsd on Monday and it was basically the same price as Indian mills, but Indian mills included some 1.5mm at same price. Today, we have cold rolled “soft” (Al-Killed) in 1.00mm at USD630/mt fob st lsd. The dilemma is that HRC has not budged downwards yet to adjust to the lower CRC prices. Will see in coming days if there’s HRC movement and let you know.

“All steel products are under pressure now, John, and we think the bubble is about to burst.”

If Chinese prices are indeed in a “bubble” that is soon to deflate, then the upward pressure on foreign steel prices will be lessened and potentially U.S. prices could come off as we head into late fourth-quarter lead times.

This is something we will watch closely in the coming days and weeks.

Written by: John Packard, John@SteelMarketUpdate.com