Market Segment

October 17, 2017

MSCI: Flat Roll Shipments Dip in September

Written by Tim Triplett

September steel shipments by U.S. service centers were essentially unchanged from September 2016. U.S. steel inventories increased on a year-over-year basis for the first time since August 2015, stated the Metals Service Center Institute in its September Metals Activity Report.

U.S. service center shipments of all steel products in September totaled 3.043 million tons, about the same as shipments in September 2016, but down 12.3 percent from August.

Service center inventories at the end of September totaled 7.794 million tons or 2.6 months on hand. That’s a 2.4 percent increase from the 7.613 million tons and 2.5 months on hand the prior year. Tons shipped per day totaled 152,200, up from 145,000 in September 2016.

Year to date through September, U.S. service centers shipped 29.561 million tons of steel products, an increase of 2.8 percent compared with the first nine months of 2016.

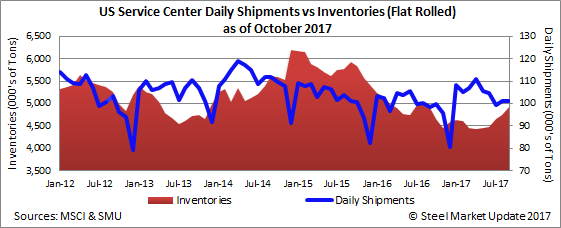

Carbon Flat Rolled

Looking at shipments by product category, U.S. service centers shipped 2.024 million tons of carbon flat roll in September, down 2.3 percent from September 2016. Flat roll shipments declined by 12.8 percent compared with the prior month.

Tons shipped per day in September averaged 101,200, with 20 shipping days in the month, up from 98,600 in September last year, with 21 shipping days.

Service centers’ flat rolled inventory on hand at the end of September totaled 4.918 million tons, or 2.4 months on hand, up just slightly from last September.

Year to date through September, U.S. service centers shipped 19.896 million tons of flat roll, a 1.9 percent increase over September 2016.

Carbon Plate

U.S. service center shipments of carbon plate products in September totaled 267,900 tons, up 4.2 percent from September 2016. Tons shipped per day in September, with 20 shipping days, averaged 13,400 tons, up from 12,200 tons in 21 shipping days last September.

Plate inventory on hand at the end of September totaled 820,800 tons, or 3.1 months of supply, 4.7 percent more than the 784,300 tons or 3.0 months of supply at the end of September 2016.

Year to date through September, U.S. service centers shipped 2.632 million tons of plate, a 5.5 percent increase over the 2.494 million tons last year.

Pipe and Tube

U.S. service center shipments of pipe and tube products in September totaled 175,200 tons, down 5.8 percent from September 2016. Tons shipped per day in September averaged 8,800, down from 8,900 last September.

Pipe and tube inventory on hand at the end of September totaled 443,900 tons, or 2.5 months of supply. That’s 7.3 percent less than the 478,600 tons or 2.6 months of supply at the end of September 2016.

Year to date through September, U.S. service centers shipped 1.687 tons of pipe and tube products, a 5.3 percent decrease from the 1,781 million tons last year.