Prices

March 5, 2018

President Trump Ready for 'Good' Trade War

Written by John Packard

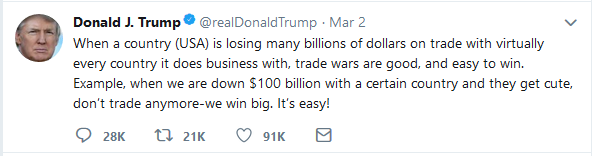

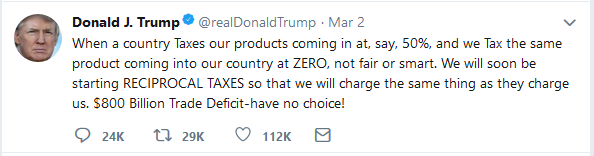

Last week, President Trump let it slip of his intention to place a 25 percent tariff on steel and a 10 percent tariff on aluminum coming from foreign sources, including our NAFTA partners. Over the weekend, countries around the world have pledged to respond to any tariffs on steel and aluminum with tariffs of their own against U.S. products. President Trump told the world that he welcomes a trade war, which he called “good” for business.

The domestic (U.S.) steel producers who make their own steel are supportive of the president’s plan to put a 25 percent tariff on every steel product. There are winners and losers within the industry as none of the West Coast steel mills make their own steel, plus you have mills in the East who also buy slabs or foreign coil as the base substrate used to make hot rolled, cold rolled, galvanized, Galvalume and Tin Mill products at their plants here in the United States.

Mills (and their customers) that may be negatively impacted by a foreign steel tariff on imported slabs, hot bands or full hard cold rolled: California Steel Industries, NLMK USA, Evraz Oregon, AMNS Calvert, Steelscape, USS/POSCO, JSW in Texas and Acero Junction.

As you can see by the tweet above, President Trump has more products in mind as he contemplates expanding the trade war with our adversaries as well as our allies.

Over the weekend, Wilbur Ross and Peter Navarro made the rounds on TV to advise everyone of the administration’s intention to include all countries in these duties.

The general manager of a steel service center had some interesting comments for us:

Well, the only good news is, we have Trump’s initial decision in hand, and apparently only one week until the final decision(s) are made public. To the extent that we don’t have to stay in limbo until April 11th, I see as a positive. The balance of course is negative and one has to hope that this announcement was done in order to “shake up” the market prior to finalizing a less onerous outcome. I expect prices to continue to soar until the market can get a grasp of the size and scope of the outcomes.

Assuming a broad-based single tariff approach, with few if any exceptions, is almost hard to comprehend as being practical. We’ve been a country whose steel consumption has been based on roughly a 20% import level for decades. To attempt to alter that scenario to basically zero, in an immediate fashion via a 25% tariff, opens up endless opportunities for highly negative outcomes. Where is the talk of quotas? Where is the talk of targeting “cheaters”? Where is the recognition that Mexico and Canada are heavily intertwined with the U.S. steel production and consumption via NAFTA, and thus carved out?

The range of imports, from common grades and sizes, to a sizable amount that is not even made in the USA, is quite vast. It’s almost as if the task of culling through the import spectrum was too much work, and thus hit everyone.

Then there’s the issue of re-rollers here who’ve relied for decades on imported slabs to produce coils. Think of UPI and CSI in California, where state-mandated environmental restrictions make melting steel prohibitive for all practical purposes (ask Nucor, which has examined this in full). Thus the reliance on re-rolling was required, and based on their coastal locations, only imported slabs made economic sense.

The truly unfortunate part of all of this is the fact that there’s widespread agreement across the U.S. metal complex that our country should punish and/or prevent the importing of illegally imported/dumped material. The U.S. domestic mills have successfully litigated dozens and dozens of cases through the proper channels as set up in the WTO. To deviate wildly from this approach, and use national defense no less, is reckless in the least.